back

|

|

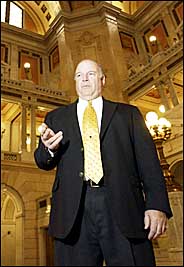

Stephen L. Flood, controller of Luzerne County, filed a racketeering suit against people who have handled the county's pension money.

Political Money Said to Sway Pension Investments

By Mary Williams Walsh, The New York Times

February 10, 2004

For more than a decade, a small group of businessmen contributed tens of thousands of dollars to the campaigns of their county commissioners in Luzerne County, a waning coal center in eastern Pennsylvania. The elected officials gave the businessmen control over the county pension fund, about $200 million at its peak. After hiring insurance companies, brokerage firms and others to manage the money, the businessmen reaped several million dollars in commissions and fees from the companies.

No one paid much attention until the market went sour. Then a quarter of the pension fund melted away. A new county controller was elected, and he concluded the flow of political money had undermined the fund.

"It was a pay-to-play system," said Stephen L. Flood, who was elected controller of Luzerne County in 2002 and ordered an audit of the fund. He and the county pension board have filed a racketeering suit against the businessmen, the county commissioners and the companies that have handled the pension money since 1988, contending that they chose unsuitable investments and drained millions of dollars through excessive fees.

The case, detailed in the lawsuit, is an unusually stark example of a claim that has been made from Connecticut to California: when elected officials sit on government pension boards, investment decisions can be tainted by campaign contributions.

Five years ago, the Securities and Exchange Commission reviewed the role of campaign money in the selection of pension investments and found evidence of a widespread problem, citing instances in at least 17 states. The S.E.C. drafted regulations to address the issue. But the project was shelved amid opposition from the financial industry and elected officials.

Today, there is renewed interest in the subject. As pension assets have dwindled in the last few years, some pension boards have begun to review their plans, looking to see how much of their losses, if any, were caused by something other than adverse market conditions. And examples of negligence and worse are beginning to bubble up.

In the Luzerne County case, which is in Federal District Court in Scranton, Pa., a lawyer for the defendants, Luigi Spadafora, said that they did nothing wrong and that Mr. Flood's audit was inaccurate, giving a misleading account of the pension values. Mr. Spadafora of the Manhattan firm of Winget, Spadafora & Schwartzberg has moved to dismiss the racketeering suit, arguing that the businessmen did not have a fiduciary duty under Pennsylvania law and that the disputed activities happened too long ago to be actionable. The businessmen have also sued Mr. Flood for defamation and contend the suit was politically motivated.

As the dispute wends its way through the court, Luzerne County is scraping together $12 million that its actuaries say is needed for the pension fund. Property taxes are about to rise, Mr. Flood said, and about 70 county jobs have been cut as a result.

Court cases like the one in Luzerne County are rare. Local pension problems usually come to light only after a new official is elected on a platform of reform or a related political scandal uncovers them.

"There are things going on all over the country all the time," said Edward A. H. Siedle, a securities lawyer and onetime fund regulator for the S.E.C. who now runs the Benchmark Companies, which audit pension funds. "Most of the public pension funds don't want to have any light shone on what they're doing. It's about political contributions. It's about friendships. It's about wining and dining and little kickbacks. It's about playing golf with the mayor. What it's often not about is the investment merits of what the given product is."

Nationwide, about 2,600 state and local pension plans hold some $2.1 trillion for more than 20 million teachers, firefighters, garbage collectors, judges and other public employees and retirees. (The figures do not include federal workers.) While the boards of public pension plans vary widely, they commonly include mayors, governors, treasurers, controllers, city councilors, state legislators, union leaders and other elected officials. A few places, like New York State, leave everything to a sole trustee — the state treasurer, for example.

Despite the potential for abuse, money managers often make campaign contributions to such officials. In the worst cases, pension trustees dole out investment business not on merit, but on the basis of who gave them money. Trustees may then overlook excessive fees or unusual portfolio turnover; they may approve unsuitable investments; or they may shrug off losses to avoid offending their donors.

In some places, audits have found campaign money at the core of sprawling and flamboyant abuses of the public trust. In Philadelphia, a group of venture capitalists who gave tens of thousands of dollars to city and state officials are now the subjects of a federal investigation, involving state and municipal pension funds in at least three states, according to someone briefed on the case. Venture capital is generally classified as a high-risk style of investing and may therefore be a debatable choice for pension funds.

But the fund in this instance, the Keystone Venture V, did more than make bad bets on companies; an internal investigation ordered by two managers of the fund in mid-2000 suggested that millions of dollars were diverted by one of its managing directors to people and businesses that had nothing to do with the stated portfolio. Connecticut's pension plan for state workers lost $20 million on a $27 million investment in Keystone V; Philadelphia's plan lost $10 million of a $15 million investment; other state and county pension funds lost still more. Keystone V is being liquidated.

Far more often than foul play, pension funds have simply been pushed to take on more risk. Because the management fees are greater on investments that must be actively managed, money managers tend to promote more stocks to pension trustees than staid bonds. They also push riskier investments, like venture capital and hedge funds.

Corporate pension plans must follow a daunting array of rules that are intended to keep them properly funded and to assure that they are not used as tax shelters. But those federal rules do not apply to state and local pension funds.

The municipal bond business was once rife with complaints about political money being traded for underwriting contracts, but the S.E.C. cracked down on that in 1994. The commission barred investment bankers from handling a city's bonds if they had contributed to any of its financial officials in the two years before the bond sale. At the time, some suggested the rule prohibiting pay-to-play activities might be extended to cover money managers competing for pension business. The idea went nowhere.

Some states have tried to take on the issue themselves, but have little to show for it. The California Legislature passed such a bill, which was thrown out by a court. In Connecticut, there have long been complaints about eager money managers sweetening their bids for pension business with cash campaign contributions — so much so that in 1994, the Republican candidate for treasurer made reform the cornerstone of his campaign. After his election, Christopher B. Burnham and his chief of staff, Paul J. Silvester, wrote a state law keeping political money away from the state pension fund. The bill was unanimously approved by the legislature.

But then Mr. Burnham left for a private-sector job, Mr. Silvester became treasurer — and was caught in his own trap. In 1999, he was indicted and pleaded guilty to charges of racketeering and conspiracy to launder money in connection with the state pension fund. In an effort to reduce his prison time, he provided testimony that described in detail the way he had circumvented his own law, taking money and favors in exchange for placements of more than $500 million of pension money.

One New York real estate investment firm that was host to a fund-raiser for the campaign of Gov. John G. Rowland got $75 million less than two weeks later, he said. A spokesman for Governor Rowland said that while the governor had attended the fund-raiser, he had not been aware at the time of any contracts that Mr. Silvester had awarded while setting it up and he had not been contacted by the federal law enforcement officials in Mr. Silvester's inquiry.

Successful prosecutions like Mr. Silvester's are rare, however. State and municipal officials say this is because there is relatively little abuse; pension watchdogs say it is because the system is built on winks and nods, not written agreements.

"Pay-to-play practices are rarely explicit," the S.E.C. noted in its 1999 report. "Participants do not typically let it be publicly known that contributions are made or accepted for the purpose of influencing the selection of an adviser."

The S.E.C. study found that many localities were awarding pension business without any sort of open competition or bidding. A few went to the trouble of putting prospective managers through a competitive process, only to pick money managers that never took part. In one noteworthy case, the city treasurer of Chicago, Miriam Santos, demanded large contributions from a number of investment firms and threatened to blackball them as pension managers if they did not pay. Her original conviction was thrown out, and she was sentenced to time already served when pleading to a single count of mail fraud before a second trial.

"It is time we put an end to the culture of pay-to-play in the area of municipal money management," Arthur Levitt, the S.E.C. commissioner at the time, announced, and issued for public comment a rule that would bar money managers from receiving any pension business for two years after giving to a fund's trustees.

But there was an outcry from the financial services industry, which said that the rule would smother companies in paperwork. State and local treasurers also objected, disputing the suggestion that they were widely susceptible to graft.

Shortly before Mr. Levitt departed in February 2001, the S.E.C. put a moratorium on new rulemaking until his successor was in place. The pay-to-play rule never came up again. A spokesman for the commission said yesterday that the matter was not being actively pursued.

In Luzerne County, Mr. Flood said that he had received inquiries from municipal officials as far away as California who wonder if something similar is happening to their pension funds. He said that when he took office he suspected many county-financed enterprises needed audits, but he thought the pension fund would be the best place to start.

"The pension fund was always the golden goose," he said. "It was the biggest amount, $200 million at one point." He cannot be sure of the size, he said, because he is unable to find details about some of the investments, like the privately held real estate trusts or a hedge fund in Bermuda.

"We have no idea how much that fund ever realized," he said of the Bermuda fund. "It's not regulated. It's offshore. It's gone. Finished."

Two accountants spent months trying to pull the records together. Rough estimates by the county indicate that the fund was down more than 5 percent in 2000 and more than 6 percent in 2001. By comparison, the Wilshire Associates survey of public pension funds with less than $1 billion in assets showed an average gain of more than 1 percent in 2000 and an average decline of nearly 1 percent in 2001. The county's performance was particularly bad in 2002 because of the liquidation of a number of contracts that created extraordinary fees. Perhaps because of the difficulty of determining the actual performance of the fund over the long term, the county's lawsuit focuses on the investment choices and the fees.

At a stormy pension board meeting, Mr. Flood fired the financial advisers, saying they had their hands "in the pot," according to The Wilkes-Barre Times Leader, which has covered the pension fight in great detail.

Mr. Flood then set about extricating the money from the companies that held it and finding new money managers, using a competitive process. A new investment policy was written: no more hedge funds, no more real estate trusts, much less risk. And a new rule was written: no more political contributions from money managers.

About $2 million had been paid annually in fees and commissions before the change. They have now been cut to

$800,000.

Copyright © 2004

Global Action on Aging

Terms of

Use | Privacy

Policy | Contact Us

|