|

|

Hispanics Divided on Retirement Changes

By April Hunt, The Orlando Sentinel

June 17, 2005

Florida's Hispanics, like those nationwide, have jumped into the debate over Social Security reform but offer just lukewarm support for plans to overhaul the system.

That's because, despite an interest in gaining more control over their retirement income as President Bush has proposed, Hispanics tend to be younger, have larger families and rely on Social Security to stay out of poverty, according to a report released Wednesday by the National Council of La Raza -- a Washington-based Hispanic advocacy group.

Even though Hispanics in the I-4 corridor drew huge amounts of attention in the 2004 presidential election because of their rising numbers at the polls, they have been hard to pin down on how Social Security should be revamped, said Eric Rodriguez, the report's co-author.

"If you look at where Latinos are today, it's where most Americans were when Social Security was first introduced," Rodriguez said. "They rely on the system."

Bush wants to revamp Social Security by allowing younger workers to invest part of their current taxes in private accounts and reducing future benefits accordingly.

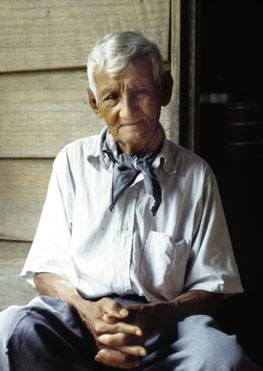

The central theme in Bush's proposal -- giving Americans more "ownership" of the investments -- strikes a chord with Martin Simonini of Orlando.

He emigrated from Argentina 45 years ago with just $50 to his name. Now 69, the restaurant owner and his wife bought property in town as their retirement investment.

But Simonini worries that few other Hispanics have done similar planning and agrees with La Raza's report that taking money out of the Social Security system for private investing is a bad idea.

"You have to teach people how to save," Simonini said. "It's very important you don't leave that out or they will throw away their money."

A study released in March showed that Hispanics are as divided over the debate as the overall population. The Pew Hispanic Center found that 49 percent of adult Hispanics supported Bush's plan for private accounts. Yet 45 percent also supported not changing the current system at all.

Social Security is projected to be solvent through 2041 if no changes are made.

Because Hispanics are younger than the overall population -- census figures show that half of Hispanics are younger than 27, while half of non-Hispanic whites and blacks are younger than 40 and 31, respectively -- they will shoulder a proportionally larger burden of keeping Social Security solvent as baby boomers retire.

In the seven-county Central Florida region, young Hispanics will reach retirement age just as Social Security is projected to run into problems. Seventy percent of Hispanics in the region are 39 or younger.

"What is quite striking is that 9 out of 10 Latinos are under 55 and they are facing an entirely new retirement system," said Richard Fry, a senior research associate at Pew Hispanic Center.

La Raza's report also frets for the few Hispanics eligible for benefits. Without Social Security, the report notes that the poverty rate of elderly Hispanics would more than triple, from 15 percent to 55 percent.

Zaidy Rivera shares that concern. The 50-year-old Orange County teacher is enrolled in a private retirement account to which she and her employer contribute, as well as in Social Security.

The Puerto Rico native likes investing and agrees that the current system is in bad shape. But she said too many people, young and old, need some guaranteed income to retire.

"There should be some type of reform, but I don't want them to get rid of it all together," Rivera said. "Many people are counting on that money."

|

|