|

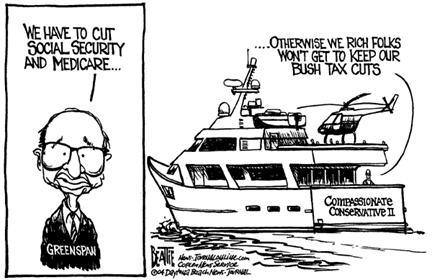

Three-Card Maestro

By Paul Krugman, New York Times

February 18, 2005

Bruce Beattie, Florida

Alan Greenspan just did it again.

Four years ago, the Fed chairman lent crucial political support to the Bush tax cuts. He didn't specifically endorse the administration's plan, and if you read his testimony carefully, it contained caveats and cautions. But that didn't matter; the headlines trumpeted Mr. Greenspan's support, and legislation whose prospects had previously seemed dubious sailed through Congress.

On Wednesday Mr. Greenspan endorsed Social Security privatization. But there's a difference between 2001 and 2005. In 2001, Mr. Greenspan offered a convoluted, implausible justification for supporting everything the Bush administration wanted. This time, he offered no justification at all.

In 2001, some readers may recall, Mr. Greenspan argued that we needed to cut taxes to prevent the federal government from running excessively large surpluses. Even at the time it seemed obvious from his tortured logic that he was looking for some excuse, any excuse, to help out a Republican administration. His lack of sincerity was confirmed when projected surpluses turned into large deficits, and he nonetheless supported even more tax cuts.

This week, Mr. Greenspan offered no excuse for supporting privatization. In fact, he agreed with two of the main critiques of the administration's plan: that it would do nothing to improve the Social Security system's finances, and that it would lead to a dangerous increase in debt. Yet he still came out in favor of the idea.

Let me make a detour here. The way privatizers link the long-run financing of Social Security with the case for private accounts parallels the

three-card-monte technique the Bush administration used to link terrorism to the Iraq war. Speeches about Iraq invariably included references to 9/11, leading much of the public to believe that invading Iraq somehow meant taking the war to the terrorists. When pressed, war supporters would admit they lacked evidence of any significant links between Iraq and Al Qaeda, let alone any Iraqi role in 9/11 - yet in their next sentence it would be 9/11 and Saddam, together again.

Similarly, calls for privatization invariably begin with ominous warnings about Social Security's financial future. When pressed, administration officials admit that private accounts would do nothing to improve that financial future. Yet in the next sentence, they once again link privatization to the problem posed by an aging population.

And so it was with Mr. Greenspan. He painted a dark (and seriously exaggerated) picture of the demographic problem, and said that what we need is a "fully funded" system. He then conceded that Bush-style privatization would do nothing to improve the system's funding.

But privatization "as a general model," he said, "has in it the seeds of developing full funding by its very nature." Nice metaphor, but what does it mean? Clearly, he was trying to create the impression of links where none exist.

Mr. Greenspan went on to concede that the opponents of privatization are right to worry about the huge borrowing that Bush-style privatization would entail.

Privatizers claim that financial markets won't be disturbed by all that borrowing because the Bush plan prescribes offsetting cuts in guaranteed benefits for the workers who open private accounts. Mr. Greenspan, who does know a thing or two about markets, put his finger on the reason why those prospective future benefit cuts wouldn't offset current borrowing in the eyes of investors: "Well, the problem is that you cannot commit future Congresses to stay with that."

Yet the chairman managed to avoid admitting the obvious - that borrowing on the scale the Bush plan requires would substantially increase the risk of a financial crisis. And the headlines didn't emphasize his concession that crucial critiques of the Bush plan are right. As he surely intended, the headlines emphasized his support for privatization.

One last point: a disturbing thing about Wednesday's hearing was the deference with which Democratic senators treated Mr. Greenspan. They acted as if he were still playing his proper role, acting as a nonpartisan source of economic advice. After the hearing, rather than challenging Mr. Greenspan's testimony, they tried to spin it in their favor.

But Mr. Greenspan is no longer entitled to such deference. By repeatedly shilling for whatever the Bush administration wants, he has betrayed the trust placed in Fed chairmen, and deserves to be treated as just another partisan hack.

|