|

|

Waging Inequality

By Lawrence Mishel, The American Prospect

February 24, 2005

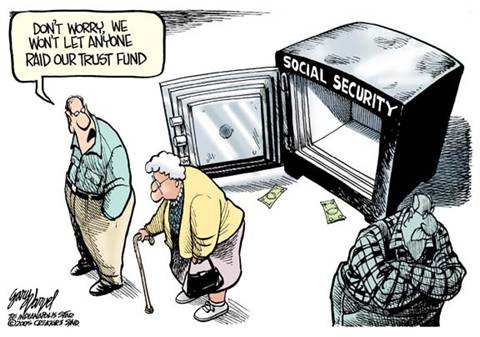

Gary Varvel

Those at the top have reaped huge gains while regular folks have just been getting by.

Many people apparently are unaware that the payroll tax is not assessed on all earnings. In 2005, current law exempts all earnings over the cap of $90,000 from taxation, meaning someone with a $1 million annual salary pays the same tax as someone earning $90,000 a year. Eliminating this cap on taxes would virtually eliminate the projected Social Security shortfall over the next 75 years, so this is no small matter. (See my colleague Josh Bivens' recent analysis, which shows the effect of eliminating the tax cap and allowing high earners to receive more in benefits.) And, because lifting or eliminating the cap is extraordinarily popular -- 81 percent of respondents in a recent Washington Post poll supported it while proposals to raise the retirement age, cut benefits, or increase the amount workers and employers pay in Social Security taxes could not marshal a majority -- you can expect it to remain a high-profile part of any debate on changing Social Security.

The policy argument for raising the cap is that the payroll tax used to be levied on 90 percent of all wages (in the early 1980s, when the last major change in Social Security

was legislated), but that now only about 85 percent of wages are taxed. The cap in taxes is tied to a cap in benefits. But, with this growth in inequality, those who are getting the maximum benefit are now paying taxes at a lower rate. The taxable wage base eroded because the wages of top earners grew far faster than the wages of the typical worker, putting more wages out of reach of the payroll tax and undermining the system. If the cap were raised to a level where 90 percent of all wages were taxed, as was the case in the early '80s, the cap would need to be at about $140,000.

This is well-known in policy circles, if not the general public. What frequently gets left out is how stunning the growth of wage inequality has been over the last 20 years or so. Consider first that the share of earners with wages exceeding the cap has actually shrunk, from nearly 8 percent in the early '80s to about 6 percent in recent years. Yet this smaller share of the workforce now earns a larger share of all wages (about 31 percent, up from 29 percent in the early '80s). That a much smaller group now commands a larger share of wage income tells us that wages at the top have risen at an extraordinary rate: The average earnings of those who earn more than the cap grew by 98 percent between 1980 and 2000. In contrast, the earnings for a typical worker have risen only modestly over the last two decades. For instance, the earnings of someone in his or her early 40s today are only 11 percent higher than someone comparably aged in 1980. Similarly, the earnings of the median worker -- the "middling worker" who earns, by definition, more than half of all workers and less than the other half -- rose 20 percent over that same time period, with the median male's earnings up only 6 percent. Consequently, the distance between high earners (those earning more than the cap) and typical earners has increased markedly: In 1980, a high earner had wages 4.8 times more than the typical earner, a ratio that reached 7.9 in 2000.

The growth in the wage gap between those at the top and everybody else has naturally translated into great income gaps between the rich and those in middle-class or low-income families. This is for the obvious reason that wage income comprises the largest part of most family's income, but also because high earners are prone to marry other relatively high earners (some say increasingly so). The top 5 percent of households earned 25.4 percent of all wages in 2000, up from 17.6 percent in 1980. That's impressive, but even more impressive is that the upward redistribution of household wages accrued almost entirely to the top 1 percent, whose share of wages roughly doubled, rising from 6.4 percent in 1980 to 12.6 percent in 2000. Most of the wage gains of the upper 1 percent actually accrued to the upper half of that 1 percent. I guess there's a pattern.

Hopefully, a focus on the untaxed (for Social Security) earnings of those at the top will bring to light one of the great stories of our era: the fact that those at the very top reaped huge gains in wages while the regular folks were just getting by.

Lawrence Mishel is the president of the Economic Policy Institute (EPI).

|

|