|

Recession Hurts Pension, Benefit Plans Worldwide

The Washington Times

May 25, 2009

World

The global economy's troubles are unraveling public and private social-security networks worldwide, and programs in wealthy nations are the most threatened, international experts say.

Potentially crippling financial losses will require mending the social-security nets that cover millions of people with a combination of pensions, disability, family benefits, injury and compensation, unemployment and sickness insurance.

Further steps to protect people's pension levels may be required, experts suggest, especially if people are close to retirement and their savings portfolios might not recover during their remaining active working life.

One of the consequences of the crisis is that in both the short and long term, the revenue bases of social-security safety nets is contracting, said Assane Diop, executive director for social protection at the International Labor Organization (ILO).

The ILO maintains that in order to protect retirees, "a minimum pension based on an assumed minimum rate of return has to be financed and or guaranteed by the state, hopefully for a transitional period."

The Paris-based Organization for Economic Cooperation and Development (OECD) has put the estimated losses during 2008 at about $5 trillion just for private pension funds. Also, an ILO report highlights that public and private funds in the United States lost roughly $1 trillion or about 10 percent of their total assets.

In a similar vein, the ILO says in neighboring Canada, public and private pensions programs have lost, so far in 2009, about 10 percent of their assets — an amount equivalent to about 6 percent of the national gross domestic product (GDP).

In the United Kingdom, pension funds lost roughly 500 billion euros between October 2007 and October 2008, and in the world's second biggest economy, Japan, private pension funds last year reported a loss of 20 percent of their assets, ILO analysts estimate and note "the downward trend continues."

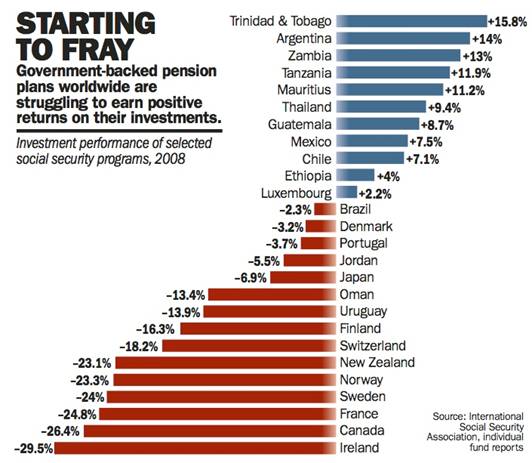

A recent survey of 47 social security institutions in 43 countries by the International Social Security Association (ISSA) estimates that pay-as-you-go programs experienced a negative performance with overall combined losses estimated at $225 billion in 2008.

"For some social-security funds, the loss represents as much as five years of investment income and around 25 percent of the net asset value of the fund," the ISSA survey said.

However, the study also found that funds of social-security institutions in emerging countries generally notched a better investment performance than those in rich nations, where some funds had high exposure in equities.

The survey data also reveal that in 2008, Ireland's National Pensions Reserve Fund (NPRF) program witnessed a decline of 29.5 percent in investment performance, France's FRR a fall of 24.8 percent, Switzerland's FC a decline of 18.2 percent.

By comparison, Brazil's PenFunds experienced a fall of only 2.3 percent, while Mexico's (IMSS) closed the year with an increase of 7.5 percent, and Thailand's SSO also finished up 9.4 percent, the survey found.

ISSA analysts say the better investment performance of programs in emerging nations may be attributed to a number of reasons: national funds that cannot be invested abroad, investments concentrated in fixed assets or markets that were not seriously impacted by the crisis in 2008.

Helmut Schwarzer, secretary of social insurance at Brazil's ministry of social insurance, told The Washington Times that supplementary pension funds in his country had some losses in stock-market investments but noted that investment in real estate in Brazil "did not fall the same way as they did in other countries."

"Real estate in Brazil didn't collapse. On the contrary, it continued to deliver good yield in terms of investment for the pension funds and public bonds were also stable," he said.

Some lessons from the crisis, ISSA experts indicate, is that defined-benefit pensions — which are normally based on a formula of accrual rate, pensionable salary and length of employment — "attenuate the effects of the crisis [by] shielding benefits from adverse financial returns" compared with defined-contribution pensions — which are solely based on the amount contributed in the program plus investment return thereon.

Second-tier or pillar pensions, mainly defined-contribution arrangements, are being "hard-hit by the crisis, ISSA says, and argues in countries where they represent a large part of retirement income, there is a possibility that social security through basic old-age pensions or other welfare measures, may be called upon to replace part of the income loss incurred by second pillar pensions in the future.

Jean-Claude Menard, Canada's chief actuary, said the Canadian retirement system with mixed funding approaches "is well-recognized in the world for its capacity to adapt rapidly to changing conditions."

Looking ahead, Brazil's Mr. Schwarzer said only a public pension system or only a private pension system "don't do the job"

"You have to mix both systems. You need a public tier, and you need a private supplementary tier."

More

Information on World Pension Issues

Copyright © Global Action on Aging

Terms of Use |

Privacy Policy | Contact

Us

|