|

|

Marketing Surprise: Older Consumers Buy Stuff, Too

By Kelly Greene, The Wall Street Journal

April 6, 2004

Linda Carter, a 51-year-old hotel manager in Palm Desert, Calif., was planning last year to spend a thousand dollars or so on a new engine for her 1970 Volkswagen Beetle. Then a TV ad for a Sony digital camcorder caught her eye.

The spot featured a gray-haired astronaut filming Earth from space with his own camcorder. The tagline: "When your kids ask where the money went, show them the tape." Soon after, Ms. Carter walked into a local electronics store and walked out with a $1,200 Sony camcorder.

Ms. Carter was impressed by the ad's focus on her age group. "As we got older, we stopped getting attention," she says. "But we're still spending a lot of money."

The push by Sony Corp. to hook people such as Ms. Carter is part of a budding revolution in marketing. After decades of obsessing over people in their twenties, some of the world's best-known companies are setting their sights on older consumers, an audience habitually written off as poor, excessively frugal or stuck in a rut of buying the same brand.

Ford Motor Co. plans to sell a sedan for empty-nesters with a trunk that holds eight golf bags. Target Corp. stores are carving out large chunks of space for khaki pants and flowing linen separates aimed at older bodies. Music retailer Virgin Megastores is redesigning its stores to appeal to Led Zeppelin and Miles Davis fans.

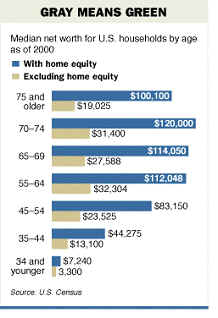

Driving the shift are big numbers. The 78 million Americans who were 50 or older as of 2001 controlled 67% of the country's wealth, or $28 trillion, according to data collected by the U.S. Census and Federal Reserve. What's more, households headed by someone in the 55-to-64 age group had a median net worth of $112,048 in 2000 -- 15 times the $7,240 reported for the under-35 age group. And within five years, about a third of the population is going to be at least 50 years old.

One challenge: How do you get the attention of older customers while making it clear to younger people that your brands are still cool? Some companies are discovering that ads featuring older people can speak to younger people too. Sony found that its commercials showing a grandmother taking underwater pictures of sharks scored well with young viewers, who related to the adventure. Other companies continue to use young models but slip in messages that are likely to resonate with older audiences -- the approach used by Anheuser-Busch Cos. in its successful marketing of the low-carb Michelob Ultra beer.

Sony has poured more than $25 million into advertising to make the company's camcorders, digital cameras and other high-end gadgets more appealing to people between 50 and 64. Sony calls them "zoomers" to reflect their increasingly active lifestyles. The push is successful so far: Camcorder sales shot up to a "high double-digit growth" rate last year, says Chris Gaebler, market intelligence and strategy director for the company's U.S. electronics unit. "Ten percent growth is considered good."

Walt Disney Co.'s Walt Disney World rolled out a program called "Magical Gatherings" last year. It allows customers to use a Web site to plan trips and is largely aimed at people over 50 who are organizing outings with golfing buddies, old schoolmates or their grandchildren.

And Microsoft Corp. started publicizing software tools in February -- with easier-to-read text, audio alerts and mouse alternatives -- to help older workers who are developing vision, hearing and wrist problems.

David Wolfe, a Reston, Va., marketing consultant who studies the 45-plus population, believes the traditional view of older consumers started to crack in early 2002. That's when Disney's ABC television network tried to grab comedian David Letterman and his younger audience for the 11:30 p.m. time slot held by 64-year-old newscaster Ted Koppel's "Nightline." Mr. Koppel stuck up for his age group, saying at the time that "60- and 70-year-old people buy things." Ultimately he kept his show, and "the imbroglio made it OK for the first time to really question Madison Avenue's thinking," says Mr. Wolfe.

Recent research has begun to cast doubt on the conventional wisdom that marketing should mainly be directed at young people. One argument runs that it's best to "get them young" because older people have already decided their brand loyalties. But a 2002 study by AARP, the Washington-based advocacy group for people over 50, and RoperASW found that for most products the majority of people over 45 aren't loyal to a single brand.

Anheuser-Busch, the largest U.S. beer maker, attempted to reach the 50-plus age group and wound up creating one of its top-selling brands. The push was sparked by the realization around 2000 that "another 29 million people would be in [the 50-to-69] age bracket by 2010, and they're living a more active lifestyle," says Bob Lachky, vice president of brand management for Anheuser-Busch's U.S. beer unit. "We thought, 'There is an opportunity here that nobody else is capitalizing on.' "

In an attempt to woo older drinkers back to beer from wine and other less-filling beverages (which people tend to prefer as they grow older), Anheuser-Busch created a low-carb formula and tagged it "Michelob Ultra." The name plays off a brand better known to older drinkers than younger ones. In 2001, the company started rolling out the product in three retirement hot spots in Florida -- Punta Gorda, Naples and Fort Myers -- and then in a few national markets.

The beer maker initially hired seven "mature marketers" age 50 and older to talk up the new brand at golf clubs, retirement communities and veterans' halls. It has since expanded the team to 36 people. As it turned out, the target audience didn't want Anheuser-Busch to "talk to my age" or show people with gray hair in Michelob Ultra ads, says Mr. Lachky. "They said, 'Talk to my lifestyle.' They were more interested in learning about lower carbs and lower calories." So advertising shifted to younger models in active pursuits.

The pitch seems to be working. The Ultra brand, rolled out nationally in September 2002, is now on the verge of breaking into the top 10 beer brands sold in the U.S. by volume, says Mr. Lachky. "You can't lose sight of what got us here," he says. "There was a nugget of knowledge in this 50-plus demographic that spawned this power brand."

Ford is attempting to solve the riddle facing all auto makers: What will baby boomers, who have snapped up sport-utility vehicles, start driving as their kids move away from home? It's a crucial question, since the average American household buys 13 new cars over the course of a lifetime -- including seven after the head of the household turns 50, according to CNW Marketing Research Inc., of Bandon, Ore.

About five years ago, as U.S. car buyers started buying more SUVs than cars for the first time, Ford's marketers started asking them why. "They told us, 'We don't feel like we're in the game when we're driving cars. There's an SUV in front of us and a big truck behind us, and it doesn't feel safe,' " recalls Amy Marentic, marketing manager for the Ford Five Hundred, a car being rolled out this fall to target older drivers. "We took that information and said, 'OK, we know boomers buy SUVs and some minivans, so let's put these guys back in the game with a car -- because we know deep down they love sedans. Once they're done driving their kids to soccer games and hockey games, they won't need

SUVs."'

The Five Hundred will include popular SUV features such as raised seating, all-wheel drive, space to haul a 10-foot ladder and a roomy trunk for all those golf bags. It's also the first Ford to be built on a Volvo chassis, in an attempt to appeal to boomers' affinity for European styling, Ms. Marentic says.

The sedan's marketing won't mention that the Five Hundred is designed for an aging population because Ford believes boomers are fighting the idea that they're getting older. The car would be a good fit for Ms. Marentic's own father, for example, who commutes 60 miles each way to his job in Michigan. "But I would never say, 'Hey, Dad, this will be easy on your back now that you're 63,' because he still runs marathons," Ms. Marentic says.

Older music lovers are an increasingly important audience for retailers at a time when many young people are downloading music free or at low-cost Web sites. Music sales slipped to $12.6 billion in 2002 from a peak of $14.6 billion in 1999. Retailers would like to take a cue from the concert business, where boomers have made $100-plus ticket prices routine and many of the biggest-grossing acts are boomer favorites such as the Eagles.

In November, the Virgin Group's Virgin Megastores revamped its San Francisco store to include sections that appeal mostly to older listeners. In the jazz section, Virgin added reproductions of 1930s jazz posters from famous clubs, reference books and Miles Davis T-shirts. In the new "mind, body and spirit" zone, there are relaxation CDs, self-help books, personal journals, yoga balls and DVDs about the Pilates exercise method. Rather than explicitly label the sections by era or age group, Virgin says they target different "lifestyles."

"There are a lot of people who want to buy music but aren't quite sure where to start," says Dave Alder, senior vice president of product and marketing for Virgin Entertainment Group, North America. (He's 39 and plays guitar in a rock band.) "If you liked Led Zeppelin in the '70s, there's no reason you wouldn't like the Darkness or Jet." Virgin started adding kiosks three years ago, with more than two million clips of songs, along with staff recommendations and reviews, to help older listeners make such links.

Virgin declined to release sales figures, but Mr. Alder says the experimental store is outperforming the company's other 21 U.S. locations. Several of those sites are set to get the same sort of makeover later this year, a spokeswoman says.

Many companies are just starting to reach out to older adults. When Procter & Gamble Co. began research 18 months ago to pinpoint a variety of consumer "segments" it should target, "it quickly became very clear, due to the sheer number of people who fall into [the 50-plus] segment, that this is ... an important group to focus on in ways that we haven't before," says P&G spokeswoman Stefani

Valkonen.

P&G has started to shake up stereotypes among its own marketers and managers. One tool: a video depicting a day in the life of an older consumer. So far, P&G has pinpointed about 30 existing products -- such as Puffs tissues and Downy fabric softener -- that it can market more directly to people 50 and older. Work has begun on advertising plans and on a new partnership with AARP that may include joint marketing and research.

Marketers at Sony had to overcome skepticism within the company before targeting older consumers. "It's very easy to convince executives here that we have to target generations X and Y, because it's easy to think that if you get that first purchase, you get set in your brand ways," says Mr. Gaebler, the market intelligence director. He used demographic research to show the significant differences in buying power between generations.

"A hundred dollars is a lot of money for a 20-year-old, but it's not a lot of money for a lot of people over the age of 50. You're at the senior end of your earning career, and you might contemplate buying a $5,000 home-theater system," he says.

Sony's commercials featuring older videographers resulted not only in a sales spurt but even more surprisingly in a boost to younger generations' "youthful perception of Sony." Mr. Gaebler thinks the younger crowd could relate to the risky feats played out in the spots, including the ad in which a grandmother gets into an underwater cage and takes pictures of sharks attacking.

The results convinced "executives inside our company that this is a group worth targeting," Mr. Gaebler says. "Now, it's almost as if we don't have a distinct 'zoomer' effort. From executives to engineers, they're thinking about zoomers when they make decisions."

|

|