|

More Americans Put

Retirement on Hold

by

Jack Broom, The

Seattle Times

December 31, 2011

Picture Credit: John Lok/The

Seattle Times

At 68, Joy LaJeret has

applied for enough jobs to recognize

some of the code phrases potential

employers use.

They

don't come right out and say, "You're

too old."

But

they might say something subtle such as:

"We're looking for someone who

would grow with the company."

She's

even heard this: "With all your

experience, you'd probably be bored

with a job like this."

But

LaJeret, of Redmond, has kept working

part-time office jobs while

training for something better. She

believes she has no choice. She

can't afford to retire.

And

she's not alone. Americans, in

ever-increasing numbers, are staying on

the job past the traditional "retirement

age" of 65.

The

percentage of senior citizens working

has nearly doubled in the past

two decades. Now roughly one in seven

Washington residents 65 years and

older is employed.

The

trend is expected to accelerate as more

baby boomers approach

retirement age. Workers 55 and older

accounted for less than 10 percent

of the state's workforce in 1990, but

more than 20 percent by the end

of 2010.

In

some professions, such as teaching,

veteran workers staying on the job

reduces the number of openings for new

candidates. And in some

entry-level jobs, such as fast-food

restaurants and coffee houses,

senior citizens are doing work that used

to be done by teenagers.

For

the first time on record, senior

citizens outnumbered teens in the U.S.

labor force in 2010, according to a

compilation by Bloomberg News of

data dating to 1948.

The

reasons people work past 65 are varied:

Some love their work. Some

hesitate to walk away from the security

of a paycheck or health

coverage.

And

some stay because the troubled economy

of the past few years pulled the

rug out from under them.

"Unless

I win one heck of a big lottery, I'd

like to keep doing this," said

Randy McDougall, 65, taking a break from

directing big trucks up the

loading ramps at the Washington State

Convention Center, a part-time

job he's had since early 2010.

For 17

years, McDougall worked at a small

company that specialized in aerial

photography.

The

firm's most dependable customers, he

said, were companies doing

large-scale developments in commercial

or residential real estate.

"When

the bottom fell out of real estate, it

hit us hard," said McDougall,

who was laid off in 2008.

Different

challenges

At the

convention center, his hours vary

greatly: He worked 97 hours in

November, and then just 45 in December,

typically a slow month for big

events.

McDougall

likes the activity, the teamwork and the

positive energy that comes

with helping transform a vast empty

space into the venue for a lively

convention or trade show drawing tens of

thousands of people.

He's

also taking classes to expand his

computer skills, which he hopes will

add to his part-time opportunities.

McDougall

and his wife, who tracks case outcomes

at the Fred Hutchinson Cancer

Research Center, are still paying on a

mortgage and car loan and aren't

sure when retirement will be feasible.

At the

convention center, workers 65 and older

make up 17 percent of the

211-member staff, and are valued for

their dependability, positive

attitude and ability to work flexible

hours.

"They

bring a wealth of life experience and

that benefits us," said Jeffrey

Blosser, the center's chief executive

officer (CEO). "They like to be

helpful and it shows. We get a lot of

great reviews from our clients

about how friendly our staff is."

Older

workers have a lower unemployment rate

than the overall workforce, but

when they do lose jobs, they take longer

to get new ones.

November

data from the Bureau of Labor Statistics

put the national unemployment

rate for 65-and-older workers at 6.7

percent, below the overall mark of

8.2 percent, not seasonally adjusted.

But

senior citizens out of work took an

average of 62.7 weeks to find a new

job, compared with the overall average

of 41.1 weeks.

Paul

Valenti, a job counselor with the

Seattle Mayor's Office for Senior

Citizens, said seniors are scrambling to

update their computer and

technology skills, required in an

increasing number of fields.

But a

greater challenge for many, he said, is

their unfamiliarity with how

the job market has changed and how

important networking has become.

Some

older workers, he said, have a "tendency

to take rejections personally,

get discouraged, and then depressed, all

of which can lead to giving up

on the effort."

Questions

about the future of Social Security

weigh on those approaching

retirement age. As the baby-boom

generation exits the working world —

many to survive well into their 80s and

beyond — a smaller pool of

workers will be available to generate

the funds paid out in Social

Security benefits.

"Full

retirement age" for Social Security has

gradually increased from 65 for

people born before 1938 to 67 for those

born in 1960 and later.

"Push"

and "pull"

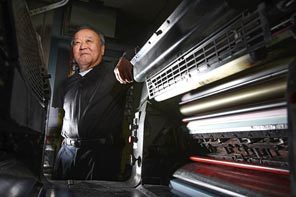

At

West Coast Printing on Rainier Avenue

South, Ted Tomita, 67, isn't

retiring, but has cut back his working

hours to between 55 and 60 a

week. That's down from 75 to 80 hours

earlier in his career.

Such

is the lot of the small-business owner.

Tomita and his younger brother

took over the business their father and

uncle started in 1930. They've

printed everything from menus to

newsletters to stationery to books —

even fortunes for fortune cookies.

"I've

been doing this so long, it's like

breathing," Tomita said. He has a

couple of younger employees who can help

with heavy lifting, but

otherwise he can still do just about

anything in the shop.

Although

he's never had a specific retirement age

in mind, he has tried to save

money for when that day comes. "I wish I

had saved more," he said.

These

days, money is tight. Not only has the

recession cut the amount his

customers have to spend, but many

organizations now do their own

small-job printing. "We've been hit

pretty hard," Tomita said. "Quite a

few print shops have gone under."

The

payoff comes when he completes a project

like the book he recently

printed for The Wing Luke Museum on the

history of the venerable Higo

Variety Store in the Chinatown

International District.

"When

someone calls you up and says, 'It's

great. You did a beautiful job,'

that's what really makes it."

Scott

Bailey, an economist with the state

Employment Security Department said

older people keep working because of

"pull" factors, which are reasons

to stay on the job, and "push" factors,

reasons they can't retire.

"I

definitely have both," said Dale

Burdett, 78, of Edmonds. He's at work

by 7 a.m. every weekday, stocking the

dairy section at Petosa's Family

Grocer, where he also runs a check stand

at busy times.

He's

been at the store 15 years, and enjoys

being active, useful and

connecting with customers. "I've seen

too many people retire and then

go home and kind of fade away."

Working

doesn't bother Burdett. Never has. When

he was 12, growing up in

Edmonds, he and his two brothers popped

popcorn to sell at the ferry

dock for 10 cents a bag. As teens, they

helped clean up a cafe their

mother ran.

Their

father worked until 80 as a salesman for

Darigold.

Before

the grocery-store job, Burdett put in

more than 20 years as "rack

jobber."

That's

the music-business version of a

door-to-door salesman who calls on

stores with records, tapes and CDs. The

job provided a small pension,

but Burdett said some of his investments

have suffered over the years

in volatile stock markets.

His

wife retired 20 years ago from work in

grocery and department stores.

"This

job has really helped keep us above

water," Burdett said. And there's

another benefit: "My doctor said I look

better now than I did three or

four years ago."

Denise

Klein, CEO of Senior Services, said her

agency is hearing from more

people older than 65 who are staying on

the job — or looking for jobs —

to meet basic financial needs.

But

besides money, many find a "sense of

meaning and purpose" in their

careers, Klein said.

Today's

65-year-olds are healthier and will live

longer than those of a

generation ago, and have a lot to

contribute, she said.

For

her part, Klein, 69, had no interest in

retiring at 65. "I've always

thought work was a very positive

experience, and why wouldn't I want to

do it as long as possible?"

Impact

of divorce

Alice

Fabre, of Seattle, is 62, but already

knows she'll need to work past 65

"just to have something to live on."

Fabre,

who is African-American, said news

stories about the employment picture

often fail to note the higher jobless

rates for people of color.

Nationally, the unemployment rate for

African-American workers was 14.9

percent in November, more than double

the rate for whites.

In her

last job, Fabre worked in the billing

department of a cardiology

practice, a job that ended last summer

when the doctors joined a

hospital.

She

has supported herself since a divorce in

the 1970s, doing a variety of

administrative jobs. Her favorite was a

Seattle schools post in the

1980s, coordinating a project to help

at-risk teen girls — a job that

ended when federal funding ran out, she

said.

As she

contemplates working past 65, Fabre

considers herself fortunate that

her 22 years in the Army Reserve and

National Guard qualify her for

lifelong health care.

She'd

love to find a job with a nonprofit

social-service agency that has a

direct impact in the community. "I want

to be vital, vibrant,

interacting with people," she said. "I

want to keep my mind sharp and

alert. I don't want to just

deteriorate."

A

divorce was also a major career-shaper

for LaJeret, sending her to

college for the first time at 33 as a

mother of five. At that point,

she said, "I'd never given a thought to

being on my own."

She

has since earned a bachelor's degree in

sociology and a master's in

political science, with a minor in

criminology and law. Through a

federal program to retrain older

workers, she's taken classes at

Bellevue College to become certified to

teach online

For

now, she's working 16 hours a week at a

student help desk at the

college, and in an unpaid internship,

she's working on a curriculum for

a criminal-justice class, experience

that will help prepare her for

teaching.

Her

current husband was laid off from Boeing

in 1999, has worked a

succession of other jobs and is in a

warehouse job scheduled to end in

February.

LaJeret

said that over the years, her jobs have

typically been part time or

low-paying, so she doubts Social

Security will be a big help in her

retirement years.

"I've

never paid enough in to be able to take

enough out," she said. "I'm

looking at working for as long as

possible."

|