|

Finding Them Easier Prey,

Scammers Target the Elderly

David

Crary, Associated Press

March 5, 2012

Boomers,

beware: Scams, frauds and other financial

exploitation schemes targeting older

Americans are a growing multibillion-

dollar industry enriching the schemers,

anguishing the victims and vexing law

enforcement officials who find these

crimes among the hardest to investigate

and prosecute.

Researchers say only a fraction

of the elder abuse gets reported to the

authorities, often because victims are

too befuddled or embarrassed to speak

up. Even with the reported cases, data

is elusive because most federal crime

statistics don’t include breakdowns of

victims’ ages.

Nonetheless,

there’s ample research to convey the

scope of this scourge.

A

federally funded study conducted for the

National Institute of Justice in 2009

concluded that 5 percent of Americans 60

and older had been the victim of recent

financial exploitation by a family

member, while 6.5 percent were the

target of a nonfamily member. The study,

led by psychologist Ron Acierno of the

Medical University of South Carolina,

was based on input from 5,777 older

adults.

A

report last year by insurer Met- Life

Inc. estimated the annual loss by

victims of elder financial abuse at $2.9

billion, compared with $2.6 billion in

2008.

Older

Americans are by no means the only

target of schemers and scammers, but

experts say they have distinctive

characteristics that can make them

tempting prey.

Some

have disabilities that leave them

dependent on others for help; others are

unsophisticated about financial matters

or potential pitfalls on the Internet.

Many are relatively isolated and

susceptible to overtures from seemingly

friendly strangers.

“That’s

why telemarketing scams are so

successful,” said Karen Turner, head of

a newly formed elder fraud unit in the

Brooklyn District Attorney’s Office in

New York City. “They’re delighted to

have someone to talk with — they almost

welcome the calls.”

Coupled

with these factors, most older

Americans, even in these troubled

economic times, have tangible assets in

the form of homeownership, pensions and

Social Security income that scammers

seek to exploit.

Another

factor is the older generation’s

patriotism and respect for authority,

according to Sid Kirchheimer, who writes

a weekly “Scam Alert” column for the

AARP Bulletin.

“A

lot of the scammers pretend to be with

the government — they say they’re

calling from the Social Security

Administration or the IRS,” Kirchheimer

said. “People 65 and over, they often

fall for that.”

There’s

a multitude of scam scenarios, some of

them new twists on old ploys.

Among the current variations:

•

The

Grandparent Scam: Impostors,

often calling from abroad, pose as a

grandchild in need of cash to cope with

some sort of emergency, perhaps an

arrest or an accident. The grandparent

is asked to send money and urged not to

tell anyone else about the transfer.

Police

in Bangor, Maine, said a man in his 70s

was bilked out of $7,000 in January by a

con artist pretending to be his grandson

who called to say he needed money to get

out of jail in Spain.

In

another version, scammers pose as

soldiers who have been serving in

Afghanistan and call grandparents,

claiming to need money as part of their

homecoming.

•

The

Lottery Scam: Scammers inform

their target that they have won a

lottery or sweepstakes and need to make

a payment to obtain the supposed prize.

The targets may be sent a fake

prize-money check they can deposit in

their bank account. Before that check

bounces, the criminals will collect

money for supposed fees or taxes on the

prize.

Police

in Holden, Mass., say an 80-year-old

woman recently was bilked out of

$400,000 over the course of a year in

her efforts to claim bogus prize money.

In Los Angeles, authorities said last

year that an 87-yearold widower fell for

a lottery scam masterminded in Quebec

and mailed $160,000 in checks that he’d

been told was for taxes on his purported

$3.3 million in winnings.

Many

recent lottery scam calls have come from

Jamaica, to the point where its area

code, 876, is now cited as a warning

sign by anti-scam experts.

•

The

Toilet Paper Scam: Fraudsters

often try to persuade gullible targets

to pay exorbitant sums for unneeded

products and services, as exemplified by

a scam uncovered in South Florida last

year.

According

to U.S. investigators, salespeople

claiming their company was affiliated

with federal agencies told their elderly

victims they needed special toilet paper

to comply with new regulations and avoid

ruining their septic tanks. In all,

prosecutors said the company scammed

about $1 million from victims across the

country, including some who purchased

more than 70 years’ worth of toilet

paper.

Three

suspects in that case, all from

Florida’s Palm Beach County, pleaded

guilty to wire fraud. But officials say

arrests are the exception, not the rule,

especially in telemarketing and Internet

scams, where there’s no paper trail and

no face-to-face interaction and where

the perpetrators are often abroad.

“It’s very hard for us to

investigate overseas — the likelihood of

us finding them and extraditing them is

slim,” said Turner, the Brooklyn

prosecutor.

Cases of financial elder abuse

surface at all levels of U.S. society.

For

example, Anthony Marshall, the son of

multimillionaire philanthropist Brooke

Astor, was found guilty in 2009 of

exploiting his mother’s dementia to take

millions of dollars. He’s free pending

appeal.

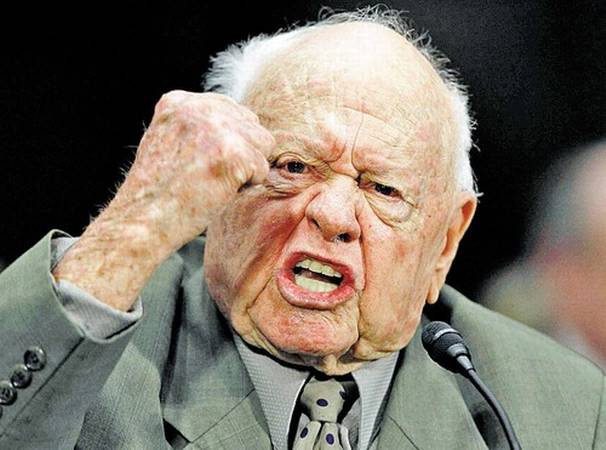

Mickey Rooney, the 91-yearold

actor, is suing his stepson and others

on allegations they tricked him into

thinking he was on the brink of poverty

while defrauding him out of millions and

bullying him into continuing to work.

The case is pending in Los Angeles

Superior Court.

“I felt trapped, scared, used

and frustrated,” Rooney told a special

Senate committee considering

abuse-prevention legislation last year.

“But above all, when a man feels

helpless, it’s terrible.”

For elderly scam victims of

modest means, the results can be

catastrophic.

“The abuse can leave a person

devastated,” Turner said. “They’re not

young to enough to grow a nest egg again

— the nest egg is gone.”

|