|

|

Not Saving Social Security, Again

by William O'Rourke, The Huffington Post

February 15, 2012

The Republicans, once again, have "caved" on

allowing the extension of the payroll tax reduction -- if you consider

furthering their anti-Social Security strategy an act of caving. Among

the many stories the media has misreported over recent decades, Social

Security is one of the most egregious. I have been writing about Social

Security on and off for over twenty years, but the subject bears

repeating. Even calling the monies going into the program a "payroll

tax" is misleading. They are premiums, since Social Security is an

insurance program.

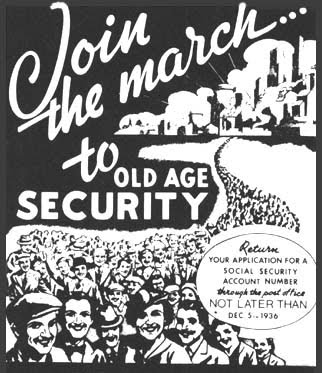

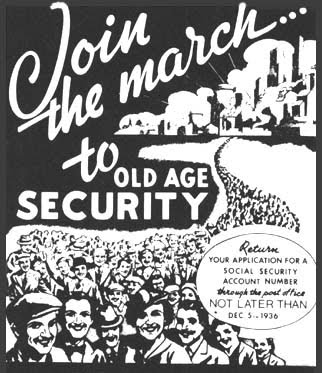

It is actually the federal "Old Age, Survivors, and Disability

Insurance" program. So, you may call them taxes, but they are premiums.

Do you want to stop paying your fire, car, life insurance premiums?

Insurance is usually a bet, because no one knows what hazards lie ahead

or how long anyone lives. Do you moan the loss of your car insurance if

you never have a wreck? The system works, since there are different

outcomes for different people. It needs to be a pool of most everyone

to insure a basic floor for everyone.

The anti-Social Security privatizers, through their various "think

tanks" and talking heads, have spread so much misinformation about the

program over the last three decades, it is no surprise that so many

people are confused.

A curious shell game is being played by the anti-SS forces: they have

convinced most journalists that Social Security is supposed to be a

"pay as you go" system. It is actually a transfer system, where one

generation transfers wealth to the next. There wouldn't be a trust fund

surplus nearing $3 trillion if it was, or had been, a pay-as-you-go

system. But, the fact that Social Security has taken in for years more

than it has put out has somehow been ignored, made meaningless. It's

the new GOP mantra: keep saying it until people believe it.

George W. Bush, during his push for privatization, called the bonds

issued to cover the Social Security surplus over the years worthless.

(Tell the Chinese that the bonds they have been buying from us are

worthless; see what kind of reaction you get.) Now the yearly surplus

is less, but it remains -- because of the intetrest paid on Social

Security's total income, according to the Social Security Media Watch

Project. If the unemployment rate was cut in half, one wouldn't even

have to count the interest to see a yearly surplus.

But, GOP politicians and some journalists don't consider the Social

Security trust fund surplus a surplus; they consider it debt, because

it has been spent: given to Wall Street and the military industrial

complex, mainly. We arrive at the sad irony that America's working

stiffs have been paying the bonuses for all the investment bankers over

the years, as well as for our wars in Iraq and Afghanistan that

President Bush kept off the books, while lowering taxes for the wealthy

at the same time.

But, the shell-game of now-you-see-the-surplus-now-you-don't in the

media continues. Journalists at both the Washington Post and the Kansas

City Star have swallowed the sugar water that it doesn't really exist.

In the Post, Lori Montgomery wrote in October, "The 2.6 trillion Social

Security trust fund will provide little relief," and E. Thomas

McClanahan, on the K. C. Star's editorial board, claimed recently, "The

payroll tax holiday is also destroying the myth of the trust fund."

Such remarks have now become the chief talking point of the anti-Social

Security forces. Of course, they don't say what I've said: We've stolen

the payroll "tax" surplus over the years to fund the 1 percent.

And now, we have the sad, smaller irony that the American workers are

continuing to provide for Obama's administration tiny stimulus program,

by means of lowering the "payroll tax." We paycheck workers are giving

ourselves the puny amounts each month that Obama takes credit for.

This is even worse. Everyone is used to the Republicans trying to

damage Social Security. But it is the Democrats who need to be watched.

They like this "tax" break because it is so "efficient." No need to cut

checks, start a program. Just reduce the amount coming in, and, voila,

money in everyone's pocket. Of course, it is their own money, which is

being taken out of their insurance system and will eventually have to

be put back - but at what cost? More federal workers furloughed? More

Medicaid and Medicare cuts?

It was too tempting for the Democratic suits in Washington, all that

efficiency. They consider it a version of domestic realpolitik. But

their chipping away at the system allows other attacks to wiggle in.

They've managed to give Social Security one fatal attribute of the

401(k) "retirement" program. It can be raided, gotten to when

"emergencies" arise, which is why, among other reasons, so many 401(k)s

have such small amounts in them at retirement.

But, again, the chief irony is that working Americans have been funding

the bubble spending, the wars and the bonuses, as George W. Bush

merrily spent the Social Security trust fund surplus and now everyone

bemoans the deficit and wants to have the people, the workers, who

contributed the cash for the bubble, take the hit and change Social

Security so they will be paid back less, get fewer benefits and take

the haircut that the Wall Streeters have avoided, in order for the rich

to continue to give less and take more.

|

|