December 19, 2007

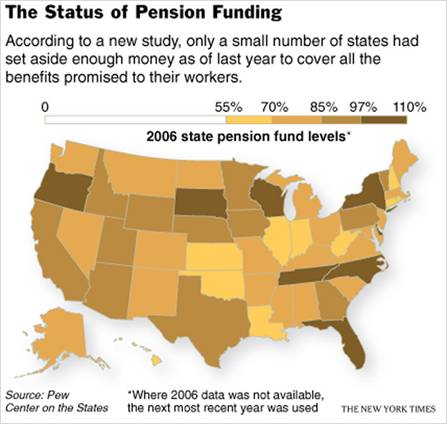

Almost half of the states have been underfunding their retirement plans for public workers and may have to choose in the years ahead between their pension obligations and other public programs, according to a comprehensive study to be released to the public on Wednesday.

All together, the 50 states have promised to pay some $2.7 trillion in pension and retiree health benefits over the next 30 years, according to the Pew Center on the States, which spent more than a year studying the issue.

The amount does not include separate retirement plans run by local governments.

While some states are managing their costs reasonably well, the center found that others, like New Jersey and West Virginia, have made serious mistakes and are now cutting education and health programs as they struggle with costs incurred decades ago.

Still more states are at risk of being caught in a similar squeeze, the center said, because they are not setting aside enough money now, as their populations age and more public employees approach retirement.

“It is a huge bill,” said Susan Urahn, managing director of the center, a nonpartisan research group that studies public finance and other civic matters.

By way of comparison, $2.7 trillion is roughly the value of all investments worldwide in information technology last year, one of the study’s authors, Richard Greene, said.

Ms. Urahn said that the magnitude of government legacy costs was poorly understood and that one of the center’s goals was simply to establish where things stood.

Until now, there has been a paucity of independent data, making state-to-state comparisons nearly impossible. Previous attempts to rank state pension funds have been foiled by differences among plans. And efforts to describe the “average” public pension fund have failed to show where the biggest problems were occurring, or to give credit to the most successful states.

Unlike companies, state and local governments are not subject to federal pension laws, which set uniform standards for private industry. If a company skips its required pension contributions, it can be required to pay a big excise tax. No comparable enforcement mechanism exists for states.

Even in the absence of federal oversight, some states, including Alabama, Arkansas and North Carolina, have been diligently prepaying their retirement obligations, the center found.

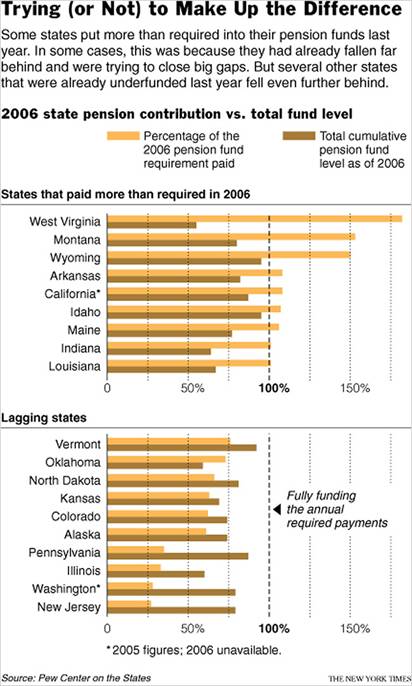

But others have consistently let their contributions lag behind the amounts needed. The study showed that about half the states fell into each category.

Among the states that have fallen behind, some, like Florida and Iowa, have been skimping only slightly. But several — including Illinois, Kansas, Oklahoma, Michigan, New Jersey, Virginia and Washington — have contributed far less than the required amount, year after year.

Other states appear to have been fully funding their pension plans, only to run into trouble in the last few years, at which point they started to fall behind. States in this situation include Colorado, Kentucky, Maryland and Ohio.

Even in the most extreme cases, Ms. Urahn said, the public may not be aware of any problem because there is always enough money to keep sending out pension checks, and retirees do not complain. But once the money dedicated to pensions starts being depleted faster than it is replenished, financial problems are likely. The further behind a state falls, the more cash it has to come up with each year to catch up.

At some point, the ailing retirement system can start to dominate the state’s overall finances, taking cash away from other important programs. Ms. Urahn said New Jersey was “a great example.”

“Large underfunded long-term liabilities put future budgets — and taxpayers — at risk,” the center said in its report. It said that paying each year’s required contribution was essential, even though doing so “requires a great deal of political fortitude and the kind of long-term thinking that is hard to come by, particularly in difficult economic times.”

The report also noted that besides pensions, most states had promised health benefits to retired public workers and are only now starting to grapple with those costs.

Retiree health plans run the gamut, from very rich to bare bones. Some states, like New York, have succeeded in maintaining well-financed pension plans, only to find themselves forced to come up with tens of billions of dollars more, because they promised retiree health care and did not set aside any money to cover that.

The center pointed to several states with grievous records that are now trying to turn the corner.

One is West Virginia, which has a chronically weak pension fund. By 2003 the fund had dwindled to a point where it had just 39 cents for every dollar it owed retirees — a level comparable to that of some airline and steel company pension funds that failed and had to be taken over by the federal government.

States cannot turn to Washington for help, and in the last few years West Virginia’s leaders have decided to start contributing substantially more than the actuarially required amount.

This effort “is starting to pay dividends,” the center found, noting that West Virginia now has 55 cents on hand for every dollar owed. The more any employer has in a pension fund, the more of the plan’s overall cost will be paid by investment returns. If West Virginia can manage to stick to this new approach, it should ultimately realize long-term savings.

Ms. Urahn said that Kansas was also attempting a course correction, establishing a rule this year that would require government employers to make pension contributions that at least cover the value of the year’s benefits earned. The rule will be put to the test for the first time in 2008, so its efficacy is not yet known.

The Pew Center on the States is a nonpartisan research body sponsored by the Pew Charitable Trusts.

More

Information on US Social Security Issues

More Information on US Private Pension Issues

More Information on Trade Unions and Pension Issues