back

|

|

Beware of Groups Bearing Reforms for Social Security

By Betty Booker, The Richmond Times Dispatch

January 26, 2004

In case you missed the warning flag waved in the State of the Union speech, we're about to be given an "opportunity" to run traditional Social Security into a deep hole. It's labeled a "reform."

The actual words were: "Younger workers should have the opportunity to build a nest egg by saving part of their Social Security taxes in a personal retirement account. We should make the Social Security system a source of ownership for the American people."

Many congressmen leapt to their feet, applauding loudly.

Not much to go on, is it? But enough has already been said to decipher this cryptic reference.

Instead of getting guaranteed Social Security payments when we retire, we'll have the "opportunity" to invest part of our Social Security contribution on Wall Street - and run the risk of losing it. And we'll make the Social Security system even more unsound after 2025 than it already is predicted to be.

Workers and employers now equally divide the 12.4 percent in Social Security (FICA) taxes. (The self-employed pay the whole thing.) That's what funds Social Security.

In 2001, President Bush picked his Commission to Strengthen Social Security. However, unlike other presidential commissions, which seek a consensus of divergent views on major social policy changes, this commission consisted only of people who support partial privatization.

Naturally, the commission came out with several recommendations favoring "partial privatization." (Actually, some members have advocated doing away with Social Security by privatizing the whole program.

Translation: No more Social Security. You're on your own, so sink or swim. If you can't, don't or won't save enough, tough.)

One of the commission's proposals is to let workers take about 20 percent of their Social Security tax and open individual private accounts. This would drain traditional Social Security of more than $2 trillion.

Another choice would let us take about 36 percent of our Social Security contribution (up to $1,000 a year) and invest that on our own. This would drain traditional Social Security by almost $3 trillion.

First, though, American taxpayers will pay $1 trillion (some analysts think it would cost two times that, or more) to convert the nonprofit, low-overhead Social Security Administration into a system from which Wall Street can make a profit.

You'll be able to stay in traditional Social Security, privatization supporters counter. True enough, but as money drains out of the program into individually owned accounts, there won't be enough to pay benefits to those who stay in the program. Benefits would have to be cut.

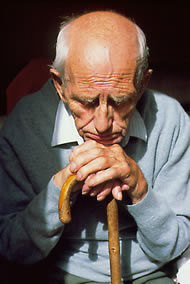

Naturally, this could have adverse effects on seniors, widows, the disabled and children getting Social Security retirement, disability or survivor benefits.

Estimates of total national deficits over the next 10 years by various economists already range from $1.4 trillion to more than $5 trillion.

There is no doubt that Americans need to save more for old age, but privatizing our "safe money" is not the way to do it.

Americans, especially baby boomers reared on instant gratification and credit cards, apparently aren't going to save voluntarily unless times get so lean that it's save or starve.

Former Social Security Commissioner Ken Apfel, now a professor of public affairs at the University of Texas at Austin, suggested in a telephone interview that one option might be to fund individual private investment accounts with a small new savings tax. Social Security would be kept separate and tweaked to make it actuarially sound.

Of course, Americans have long had the option to save and invest for a rainy day - outside or inside tax-deferred accounts.

Too many of us have been ambling along, paying no more attention to our coming old age than we are paying to government ideologues with goals that don't reflect those of most middle-and working-class Americans.

Copyright © 2002

Global Action on Aging

Terms of

Use | Privacy

Policy | Contact Us

|