Pension Sector: Reforms Not In Sight

By: Sitanshu

Swain,

The Financial Express

March 17, 2003

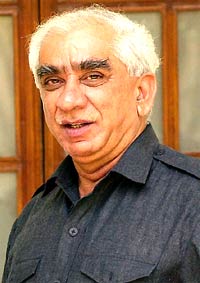

There were high expectations on

social securities from Jaswant Singh’s maiden Budget (2003-04). But

instead of announcing any detailed social security measures which would

have kickstarted the pension sector reforms, Mr Singh preferred to make a

few announcements, including the 9% special pension scheme called

Varishtha Pension Bima Yojana to be implemented by the Life Insurance

Corporation (LIC) and the formation of Pension Fund Regulatory and

Development Authority.

The scheme

has some attractive features and is expected to gross a huge premium

income for LIC. Market sources say that since the scheme involves

government subsidy, there will be restrictions for buying the LIC’s new

cover. For eg., gifting such a policy may not be allowed by the centre.

However, Mr SB Mathur, chairman, LIC, says that the return on the scheme

is taxable and a person buying more than one policy will not be allowed.

LIC is expecting a 2% subsidy from the centre to manage the 9% scheme. If

it continues for a longer period and the interest rate continues to fall,

the subsidy portion will go up, which may not find favour with the

government.

Mr Mathur

says that LIC is planning to launch two schemes as a part of 9% pension

plan: one will be returning the capital at the end of the policy

completion, while the other will not be returning the capital which will

make investment cheaper for getting the stipulated return within Rs

200-2000. Any Indian citizen between 55-75 years of age can get a pension

ranging from Rs 200-2000 on the basis of his investment. The product is

expected to be launched in April after getting approval from Insurance

Regulatory and Development Authority (IRDA).

Says Mr Sunil

Sharma, Chief Operating Officer, Max New York Life Insurance Company,

“The creation of the Pension Authority will open the door to pension

reforms. We are confident that the new authority will develop the market

and guide the new entrants into the pension market and help the industry

grow in the same manner as IRDA.”

The special

pension policy with 9% guaranteed returns is a notable gesture and will

undoubtedly make pensions popular. According to Mr Sharma, it is the first

time that a FM has provided a strong impetus to the core building blocks

of our economy, including healthcare and education. The proposed scheme

for the aged, while creating some financial burden for the Centre, is a

desirable social objective. At the same time, it raises important

questions about creating a level playing field for all insurers and not

providing sovereign guarantees to a section of the industry.

Agrees Shikha

Sharma, CEO and MD, ICICI Pru Life Insurance, “As a private life

insurance player, we’re disappointed in not being given the opportunity

to participate in the mass pension area like the one to be launched by LIC

for individuals aged 55 and above. Private players have done much to

expand the retirement solutions market, reflected in their combined market

share of over 30%, and ICICI Prudential would have been happy to have an

opportunity to participate in this mass pensions segment.”

Pensions,

after the liberalisation of the insurance market, is an already tested

market. Along with LIC, a few private pension funds have also come up. The

contributions to pension funds get a tax exemption up to Rs 10,000. The

Kelkar Committee has recommended that the incentive be extended to

contributions up to Rs 20,000 a year, but in the form of a 20% tax rebate

rather than as exemption. However, these pension funds are seen to cater

to the well-off. The labour ministry is moving ahead with plans to

formulate social security for the unorganised sector.

While the

government would be wary of taking on fiscally onerous obligations even

for the welfare of the unorganised sector, it would be willing to extend

fiscal incentives to get structured pensions that are partially funded.

This is because pension funds also act as suppliers of long-term capital

of the kind needed by infrastructure projects.

Promoting

infrastructure is another key concern of the government in the current

Budget. Encouraging genuine long-term savings is a key concern, which

needs to be put into perspective in the backdrop of rising inflation and

low interest rates.

Speaking

about the current scenario, ICICI Prudential Life chief marketing officer

Saugato Gupta pointed out that the highest sale of the company has been in

pension products, where his company alone has a 25% market share. Other

insurance companies are also targeting funds invested annually in public

provident fund (PPF) schemes for the sale of its proposed annuity

products. PPF has a sizeable and growing corpus well in excess of Rs

70,000 crore, which has not been tapped by life insurance companies. The

above 22% savings rate in India affords immense potential for the sale of

annuity products, especially when the country does not have any social

security net.

All annuity

products have an underlying guaranteed rate of return, in the region of

4%-5%. Based on minimal interest rates, all insurance policies have a

guaranteed 3% return. “We have to operate in a challenging regulatory

environment even as interest rates are low,” said Jim Morrison, VP, Om

Kotak Life Insurance.

But insurers

had expected the Budget to double the tax benefit available under Section

80 CCC(i) to Rs 20,000 for investments made in pension plans in line with

the Kelkar Committee recommendations. At present, Section 80 CCC(i) allows

deduction from gross income for investments in any pension product up to a

ceiling of Rs 10,000. Insurance companies have been urging the government

to allow a tax deduction ceiling of at least Rs 40,000. The IRDA had

proposed a hike in the exemption on pension savings to Rs 40,000 and had

submitted its draft report on pension reforms last year to a committee

that included representatives from the ministries of finance, labour,

social welfare and law.

The industry

expects the creation of a sub-limit under Section 88 for insurance and

pension products. The tax issue had been addressed because pension

products needed to be at par with other financial products.

The

recommendations of the VU Eradi Committee are also expected to come

through. It had looked into issues pertaining to the taxation of life

insurance companies. While the proportion of the aged and non-working in

the population who claim pensions have grown, that of young earners, out

of whose tax payments pensions have to be paid, has dwindled. The way out

is to have funded pensions, with working people systematically tucking

away some of their income for securing a post-work income.

Copyright

© 2002 Global Action on Aging

Terms of Use | Privacy

Policy | Contact Us

|