|

Happy

Birthday. Vacate Your Office.

By

Julie Creswell and Karen Donovan, New York Times

December 8, 2006

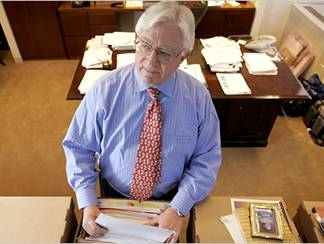

Shiho Fukada for The New York Times

A. Paul Victor, who turned 68 last

month, was forced to leave Weil, Gotshal & Manges even though he

wanted to stay. He moved to Dewey Ballantine.

As November drew near, A. Paul Victor, who spent decades at the law firm Weil, Gotshal & Manges defending corporate clients, kept a close eye on the calendar.

For Mr. Victor, the dreaded date, Nov. 6, was his 68th birthday — the mandatory retirement age at the law firm.

The problem was Mr. Victor was not ready to turn in his BlackBerry and give up meetings with clients around the globe for a regular golf date. So, saying his goodbyes after 38 years as a partner at Weil Gotshal, Mr. Victor moved a few blocks south — to the Midtown Manhattan offices of the rival firm Dewey Ballantine, where he was named a partner in its antitrust

group

“I don’t think that Weil Gotshal was overly thrilled that a partner who had been with them as long as I have went off to another place, but they understand it,” said Mr. Victor, casually dressed in a light blue sweater as he sat in his new office at Dewey, piled high with yet-to-be-unpacked cardboard boxes.

“Ultimately, it was their decision.”

It is a decision that a growing number of large white-shoe law firms are grappling with as aging, yet healthy, baby boomer lawyers look to remain vital and integral rainmakers at the firms where they built their careers.

Those desires, however, are bumping up against the harsh new realities and economics that rule inside the clubby walls of many law firms.

In the past, a gray-haired semiretired partner could remain in his hard-earned corner suite, playing the role of a mentor or adviser to younger lawyers. Yet as law firms adopt a more corporatelike structure that emphasizes revenue and profits per partner, those options are becoming more limited.

That corner office and, more important, the chunk of the firm’s annual profit pool, is being designated to hungry up-and-coming lawyers and associates rather than the legal eagles who once ruled the roost.

Unlike corporate America, which, for the most part, dropped mandatory retirement ages decades ago, many big law firm partnerships are keeping up the practice of pushing out older lawyers to make room for new blood.

In a survey last year of 46 law firms with 100 or more lawyers, about 57 percent of them reported a mandatory retirement age, ranging from 65 to 72, according to a survey conducted by Altman Weil, a management consulting firm for law firms in Newtown Square, Pa.

Anecdotally, mandatory retirement ages seem to be skewing younger at a time when good health and longer life expectancy are increasing. For instance, mandatory retirement at Simpson Thacher & Bartlett is 65, but retirement benefits are capped at 62 and few partners stick around after that.

“There needs to be a re-evaluation of retirement issues in the legal community — 65 isn’t old anymore,” said Leslie D. Corwin, a lawyer with Greenberg Traurig, who has represented law and accounting firms in disputes, mergers and liquidations. Greenberg Traurig has no retirement policy in place.

A particularly brutal battle over the issue of aging lawyers is being fought in federal court in Chicago , where the Equal Employment Opportunity Commission has filed a lawsuit accusing Sidley Austin of age discrimination.

Lawyers are closely watching the Sidley case because it could ultimately lead to the restructuring of law firm partnerships; partners are not protected by the antidiscrimination laws because they are considered owners rather than employees.

The lawsuit was filed nearly two years ago on behalf of 32 older partners who the commission contends were discriminated against in 1999, when they were suddenly demoted or forced to retire.

“Our view is that the reason the lawyers were expelled is because of their age, and that’s a violation of federal law,” says John C. Hendrickson, the regional lawyer for the E.E.O.C. in Chicago . “I think as the legal profession has become more like a business, the younger people who are coming up are more anxious to get a bigger piece of the pie and the way to do that is to get rid of the elders.”

The legal tussle, which appears to be headed to trial, is getting ugly. Last month, the commission filed a protective order to block attempts by Sidley to uncover the subsequent job performance of the former partners, hoping to bolster its claims that they were demoted because of performance, rather than age. Sidley contends the firm did not have a mandatory retirement policy.

While many bar associations around the country are trying to steer lawyers facing mandatory retirement policies to pro bono work, other associations are trying to change the mind-set behind the policies themselves.

Mark H. Alcott, president of the New York State Bar Association, has created a committee that has started to approach law firms about their policies.

“I’m calling on the profession to recognize that forced retirement of partners is archaic, it’s not necessary, and I’m trying to change the culture rather than impose liability and legal solutions on law firms,” said Mr. Alcott, a litigation partner at Paul, Weiss, Rifkind, Wharton & Garrison.

A Paul Weiss spokeswoman said the firm had mandatory retirement at 70.

When Mr. Victor joined the ranks of lawyers at Weil Gotshal in 1968, he remembers it was a time of change for the firm and the industry. “It was kind of the breakdown of the old-boy network and opportunities arose,” he recalled. “Things broke down and everything opened up and it was fair game for virtually anybody with talent and skill and some luck to attract clients.”

One of his first and biggest cases involved defending the Matsushita Electric Industrial Company of Japan , which owns Panasonic, against United States television manufacturers that accused the company of dumping television sets into the United States market and hurting their business.

“The Matsushita stuff really became a career for a while,” he said. Eventually the case went to the Supreme Court, where it set a precedent cited today for summary judgments in lawsuits.

A little more than a year ago, Mr. Victor broached the subject of his retirement at a retreat for the Weil Gotshal antitrust group at a resort outside Miami . “Basically I gave them a proposal that indicated I wanted to continue what I’m doing for at least two more years,” Mr. Victor said. “And then I wanted to continue doing something perhaps other than what I’m doing for another two years. Some kind of reduced role, but I really didn’t know what that meant.”

Mr. Victor said that in June and July he spoke with nearly every member of the firm’s management committee about staying on after he reached retirement age. In early August, while Mr. Victor was traveling in California , he got in touch with someone on the management committee who said the firm decided not to allow any exceptions to its retirement policy.

“To be a healthy institution, you have to encourage people to hand off business to the younger generation,” said Richard J. Davis, a partner and Weil Gotshal’s general counsel, who volunteered that he is now 60.

Over the next 10 years, the firm expects to face this question with a lot of partners. “You can always make some exceptions; I think it’s fair to say those should be relatively rare.”

Mr. Victor, however, had other options. He was being courted by people from four other law firms, including Jeffrey L. Kessler, an antitrust lawyer with Dewey Ballantine who had left Weil Gotshal a few years ago. (Mr. Victor declined to identify the other firms.)

“We take a flexible view with someone who has the willingness to continue to practice at a high level,” Mr. Kessler said. He added that most of Mr. Victor’s clients appear to be following him in the move.

Dewey has no mandatory retirement age. (The firm has a “presumption” that the retirement age is 65, but management reviews each case, Mr. Kessler said.)

Yet Dewey is also no stranger to claims of age discrimination.

The firm is facing a lawsuit filed by a former partner, Joseph K. Dowley, who was one of 15 partners terminated in 2003. Mr. Dowley’s suit contends that 11 of those 15 partners were 50 or older, and age discrimination is among the allegations. In April, a federal district judge in Washington dismissed the claims, finding they were subject to an arbitration agreement. Mr. Dowley has appealed, and his lawyer declined to comment.

Mr. Kessler also declined to comment.

For now, many law firms are saying goodbye to productive partners, holding the line on mandatory retirement.

Mr. Davis of Weil Gotshal said the firm “will do well in maintaining the client relationships Paul had.” He added that Weil’s policy allows retired partners like Mr. Victor to practice elsewhere in competition with the firm, while keeping all of their retirement benefits. Some firms tie retirement benefits to noncompete clauses.

Enforcing mandatory retirement “inherently has some risk,” he said, “but on an overall basis, we think it’s the right approach.”

Copyright © Global Action on Aging

Terms of Use |

Privacy Policy | Contact

Us

|