|

Debt Struggles and Elderly Living

By Terry Pristin, The New York Times

November 25, 2008

The credit crisis is battering the two largest publicly traded operators of housing for the elderly. One of them, Sunrise Senior Living, is trying to stave off bankruptcy. The other, Brookdale Senior Living, is considered likely to resolve its short-term problems, but it faces a mountain of debt in the next few years.

Mark S. Ordan, chief of Sunrise Senior Living, at a residence in McLean, Va.

Its shares are trading at less than $1.

Both companies, behemoths in a largely fragmented industry, say they are taking steps to reduce costs but have pledged to refrain from cuts that could impinge on the care they offer their residents. Brookdale manages 51,847 units of retirement and assisted-living housing, and Sunrise has 50,235 units.

Once the bellwether of the assisted-living industry, Sunrise Senior Living, based in McLean, Va., has violated certain covenants imposed by its lenders on leverage ratios and has a deadline of Jan. 31 to restructure its line of credit. One analyst, Jerry L. Doctrow, a managing director at Stifel Nicolaus & Company, said Sunrise might need to raise as much as $300 million next year.

Sunrise’s new chief executive, Mark S. Ordan, a former gourmet-grocery executive who specializes in trying to rescue troubled companies, said he did not expect to wait until Jan. 31 to work things out with the lenders. “We should have an arrangement with the banks long before that,” Mr. Ordan said.

Mr. Ordan’s predecessor, Paul J. Klaassen, who founded Sunrise in 1981 with his wife, Teresa, stepped down this month. The Klaassens, who are still heavily involved in Sunrise, are regarded as pioneers in assisted living, which provides frail elderly people with an alternative to the hospital-like setting of a nursing home. But the couple’s reputation was tarnished in recent years as Sunrise became mired in accounting problems and other governance matters that drew the attention of the Securities and Exchange Commission and forced the company to restate years’ worth of earnings.

The company also stumbled when it expanded into Germany and branched into new areas, including developing age-restricted condominiums and acquiring a hospice company that was later accused of fraud in billing Medicare. “They have made a number of ill-advised investments,” Mr. Doctrow said.

Sunrise recently suffered a blow when a real estate investment trust, Health Care REIT, backed out of a $643.5 million deal to acquire a 90 percent stake in 29 properties in which Sunrise has a minority stake, citing the stalemate in the capital markets. Sunrise was to realize at least $41 million from the deal.

On Nov. 28, 2007, Sunrise’s shares closed at $32.16. But since Nov. 12, it has been trading below $1, closing at 53 cents on Tuesday.

Founded in 1986, Brookdale grew rapidly at the height of the real estate cycle by acquiring rival companies, doubling the size of its portfolio. To finance these purchases, Brookdale, now based in Nashville, took on short-term mortgages secured by its existing assets, and has about $1.6 billion in debt due by the end of 2012, according to Green Street Advisors, a research company in Newport Beach, Calif.

Brookdale, the developer of the Hallmark at Battery Park City, a 14-story retirement and assisted-living home in Lower Manhattan, is expected to cut its dividend to meet near-term obligations. The company is also reducing corporate overhead costs, trying to sell some of its unencumbered real estate and increasing the availability of services like therapy and home health care, for which the company can charge fees not included in its basic rate.

Bill Sheriff, Brookdale’s chief executive, said that in recent weeks, residents had urged him to forgo renovations to keep the company from raising monthly fees, which can run as high as $10,000. “Do everything you can to control costs,” he quoted them as saying.

Brookdale’s shares, which traded for $35.16 on Dec. 10, closed at $3.76 on Tuesday.

Though the two companies are close in size and cater to the same upscale segment of the market, they have different business models. Brookdale owns or leases most of its homes, while Sunrise is primarily a management company that develops centers and then sells them to other companies while retaining a minority stake. The average monthly fee, including housing, meals and some services, at Sunrise-operated centers is $5,000.

Nearly three-quarters of Sunrise’s units are dedicated to assisted living, aimed at people who need help with daily activities. A majority of Brookdale’s units are either stand-alone retirement homes — where communal meals are available but the population is less frail — or so-called continuing-care retirement communities, where residents initially live independently but contract in advance for assisted living and nursing care on the premises.

The occupancy rate remains strong at both companies — 92 percent at Sunrise and 89.7 percent at Brookdale, according to the companies’ third-quarter earnings reports. Both companies said expenses had increased.

In the industry in general, occupancy — especially for retirement homes — is weakening in areas most affected by the housing slowdown, said Robert G. Kramer, president of the National Investment Center for the Seniors Housing and Care Industries, a research organization in Annapolis, Md.

People planning to move into a retirement community can postpone their decision if their house does not sell. Less discretion is involved in the decision to move into an assisted-living residence, Mr. Kramer said. “There’s usually an event that triggers it,” he said.

It is not unheard of, of course, for a senior-housing company’s financial problems to spill into operations. Sunwest Management, a problem-plagued private company based in Salem, Ore., with 18,000 residents nationwide, has been fined repeatedly by regulators in its home state, who were responding to complaints about food, bills and safety, according to a recent report in The Oregonian, a daily newspaper in Portland.

But despite the anxiety about Sunrise, analysts say there are no indications so far that its operations have deteriorated. “We keep asking the same question: is management becoming distracted by all these corporate-level challenges and possibly taking its eye off the operating ball?” said Rosemary Pugh, an analyst at Green Street Advisors. “There are some real concerns, but in the midst of this cash crunch, they are performing remarkably well.”

Mr. Ordan said it would be foolhardy to reduce the level of care to save money. “Any stakeholder knows that what drives the strength of the company is that care,” he said.

At Brookdale, a chief concern is the majority stake held by Fortress Investment Group, a struggling hedge fund that owns nearly 60 percent of the company. Some analysts have said that Fortress’s interests may not necessarily be aligned with Brookdale’s. But Fortress has not pressured Brookdale to lower its standards, Mr. Sheriff said. “They have been incredibly quick to say, ‘We just don’t go there,’ ” he said.

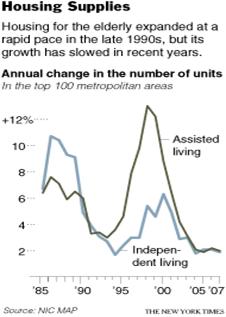

Specialists in housing for the elderly say the long-term prospects for the sector are very good because new supply is being kept in check. “As a rule, the senior-housing industry is not developing a lot of new product,” said David S. Schless, the president of the American Seniors Housing Association, a trade group. The National Investment Center found fewer than 23,000 units under construction in the 100 biggest metropolitan areas.

That is a far cry from the late 1990s, when the frenzied pace of new construction far exceeded demand, in part because developers were slow to realize that most peoplewould not move into assisted living homes until their 80s.

The slowdown means that there is likely to be a shortage of such housing eventually, said Kathryn A. Sweeney, a managing director for United States senior housing for GPT Group, an Australian real estate company. “If you plan to be a resident, you need to be saving your pennies now,” she said.

More Information on US Elder Rights Issues

Copyright © Global Action on Aging

Terms of Use |

Privacy Policy | Contact

Us

|