|

Later Life ‘Encore Work’

Replaces Income, Reinvents Retirement

By Kay Harvey, New America Media

April 16, 2012

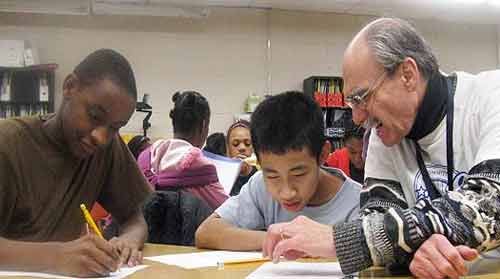

Picture Credit: Downsized boomer Bob

Hansen is pictured tutoring students

Anwar Baja and Eugene Banakweri at

Linwood Monroe Arts Plus school in St.

Paul. Kay Harvey/MinnPost

ST. PAUL, Minn.--Bob Hansen is

good at reinventing himself. It’s a

trait that has enabled him to land

paying jobs since taking a buyout five

years ago from the Ford Motor Company

plant in St. Paul. Drawing from skills

honed over the years, he has created a

patchwork of jobs, both paid work and

what some call “life work,” contributing

to his family and community.

On the heels of downsizings,

rightsizings, outsourcing and plant

closings, many older boomers don’t have

the wealth of high paying job

opportunities they once did. Hansen, 64,

has forged ahead to make work and life

decisions in line with what’s both

do-able and important to him now.

A

Bundle of Paid and Volunteer Jobs

Hansen is a boomer whose

résumé reads like a short

story. Teacher. Ordained Lutheran

pastor. Associate director of the

Chicago Cluster of Theological Schools.

Minnesota Public Radio member-services

representative. Automobile hood-fitter.

At 64, he has created a bundle of

part-time jobs to supplement his pension

from Ford and a portion he receives of

his late wife’s Social Security.

In addition to tutoring and

mentoring junior-high and high-school

students, he provides quality control

for a realty company and teaches a

weekly Bible-study class at his church.

Hansen’s favorite day is

Wednesday. “That’s Grampa Hansen day,”

he said. He spends it each week with his

three young granddaughters.

Many older boomers who leave

career jobs go looking for “encore

work,” said LaRhae Knatterud, director

of aging transformation at the Minnesota

Department of Human Services. Her job

put her at the helm of Transform 2010

and Aging 2030 studies assessing the

aging of the huge baby boom generation

(born from 1946 through 1964) in

Minnesota.

How big is huge? Nationally the

figure is 78 million boomers. A 2005

Minnesota Department of Health report

pegged the state’s number at 1.5 million

strong. By 2030, Minnesotans age 65 and

older will account for 24 percent of the

state’s population, more than double the

percentage recorded in 2000. And more

than the numbers are changing.

A

Looming Skills Gap

As older boomers leave their

jobs, many should open for younger

workers. But in somewhat of a paradox,

some employers are begging boomers to

stay in their jobs, Knatterud said. Why?

There aren’t enough younger people with

the necessary skills. Some Fortune 500

companies are struggling to replace

workers who’ve retired, she said.

“Some are stunned that there

aren’t young people coming in to replace

the boomers,” she said. That trend will

continue. One reason is apparent: Gen X,

the boomers’ children’s generation, is

half as large as the boomer generation.

“As we move into 2015 and on to 2025,”

Knatterud said, “we won’t be able to

replace the boomers.”

Another potential challenge

looms, according to a Governor’s

Workforce Development Council report. By

2018, 70 percent of Minnesota jobs will

require education beyond high school.

Yet only 40 percent of working-age

adults in Minnesota have a

post-secondary degree. And education

levels among American workers are

expected to decline in coming years – a

virtually unprecedented trend.

A similar gap is occurring in

other industries, such as manufacturing,

where most workers now need technical

skills for such tasks as programming

equipment. Area community colleges offer

the training. But taking that leap isn’t

an easy choice for some workers.

“These are physically demanding

jobs,” Knatterud said. “Some workers

don’t want to go back to school for two,

three or four years. For some, she said,

“There’s the question of ‘How far do you

go to get back in?’ ”

That is among the scenarios

that can lead to long-term unemployment.

A worker who’s laid off and cannot find

work becomes dependent on public

support, Knatterud said. “It happens to

some who were once at the top of their

game. Some are too discouraged to look

for work.” Yet for most people who quit

working after turning 55, “it’s a long

time to get by somehow.”

Hope

for the Discouraged

All Hands on Deck, an

initiative of the Governor’s Workforce

Development Council, is a blueprint for

strengthening Minnesota’s workforce and

closing the state’s skills gap. Its

initiatives and programs are geared to

people across the age span, from high

school and college students to aging

workers and people with disabilities.

One initiative offers Lifelong

Learning Accounts (LILAs), “portable

money” designated for job training that

people can use in a current job or apply

to education for a new career. Knatterud

framed LILAs as “a way of putting funds

together to change employment and be

prepared with the right skills.”

Important as it is, though,

money isn’t everything. When David Buck

was laid off a few years ago from a

real-estate company at age 46, he said,

he felt “all alone.” Then he met

visionary Jan Hively, who said, “What

you really need is community.” Buck, of

Minneapolis, forged ahead to create his

own.

Working with Hively, who had

founded the Twin Cities-based Vital

Aging Network

[http://vital-aging-network.org/], Buck

co-created SHiFT

[http://www.shiftonline.org/], which

offers sessions and workshops that have

supported dozens of people at midlife

and older seeking greater meaning in

their work and their lives.

Besides starting a nonprofit,

Buck needed to find another part-time

paying job. He decided to pursue a new

field for him: fundraising. After 75

interviews, Buck signed on for a

half-time job raising money for the

Washburn High School Foundation, where

his children were to go to high school.

Buck later took that experience

and found a part-time position with the

Benedictine Health Center of

Minneapolis. He paired that with

creation of his own consulting business,

helping churches and schools raise money

and assist them with marketing. The

combination “utilizes all of my gifts,”

he said.

SHiFT

and New Risk

SHiFT’s webmaster, Jay McManus,

describes the SHiFT network as “a

community of seekers.” Not everyone in

the network is seeking a paycheck.

SHiFT’s emphasis, Buck said, is

“a more holistic approach.” It’s people

“taking time to redefine what they want

remaining life to be like. We have broad

definitions of work – paid and unpaid.

That could mean taking care of a loved

one,” he said.

Some SHiFT participants have

transitioned into paid work after

completing a “midternship,” an

internship for people at midlife who

learn alongside a mentor skilled in work

that a midtern wants to pursue.

Knatterud cites SHiFT

co-creator Jan Hively’s philosophy:

“Productive until the last breath,” she

said. You can read to a blind person,

Knatterud suggested. Or to a child. You

can send a get-well card.

“With the ‘Great Risk Shift’

comes a redefinition of the safety net,”

Knatterud said, referring to American

society’s transfer of risks to secure

long-term financial stability, from

public and employer-based protections to

individual investments and decisions.

“Values and what’s important

start changing. There’s a redefinition

of who we turn to when we need help,”

Knatterud observed. In down times

there’s a return to the values of

family, community and helping each

other, she said.

“It’s already happening,” she

said. More Minnesota families are living

in multigenerational households. Some

share transportation, too. Along with

that, Minnesota has among the nation’s

highest rates of volunteerism.

We are still, as boomers, a

wonderful resource,” she said. Some may

not get a high-paying job. Some will

find another job and then later develop

a disability and not be able to work.

“But you can serve society in other

ways,” she said. “Think of what you can

do for your grandkids. We need to take

advantage of that now.”

|