|

|

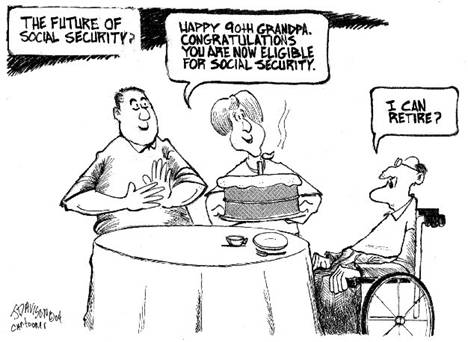

Shifts in Social Security Eligibility

By Andrea Coombes, Newsday.com

July 9, 2005

Will jobs be available if Americans work longer?

Long-lived baby boomers are going to transform the idea of retirement, working late into their golden years, right?

Certainly, statistics show more older Americans are opting to work later in life, but there remains a hefty portion of older people who consistently retire early, some economists are warning.

Whether it's because of health problems, a desire to slow down or getting laid off and being unable to find new work, sometimes the intention to work long into one's later years goes awry.

In a study based on 2004 data, the employment rate falls to 51 percent among 61-year-old women, from the peak of 76 percent among women who are 46 years old, said economist Elise Gould at the Economic Policy Institute, a Washington-based liberal think-tank. By age 65, 26 percent of women that age are working.

Among men who are 61 years old, about 61 percent work, compared with 89 percent of those at the peak employment age of 39. By age 65, 36 percent of men are working.

Gould's data snapshot is an attempt to show that a portion of older Americans stop working before being eligible even for partial Social Security benefits at age 62, and that increasing the eligibility age for full benefits doesn't remove the barriers that prevent some older Americans from working.

Gould's report is in response to policy-makers on Capitol Hill, some of whom suggest increasing the age at which Americans are eligible to receive full Social Security benefits as a solution to the program's projected funding gap.

"Raising the age doesn't help older Americans get jobs," Gould said. "If we're going to insist on people working longer . . . we have to think there are going to be that many more jobs in the economy to be able to employ people of all ages."

In 1983, Congress mandated that Americans born after 1959 collect their full Social Security benefits starting at age 67, versus age 65 for those born in 1937 or earlier. Current proposals to raise the eligibility age again would lead to reduced benefits by paying out over a shorter period of time.

Upping the Social Security age "will help the Social Security problem, but it won't help the problem of real people," said Alicia Munnell, director of the Center for Retirement Research at Boston College. She cited the Employee Benefit Research Institute, a nonpartisan research group, which for about a decade has surveyed workers and retirees on retirement issues.

On average, those surveyed retire at age 62. About 40 percent of retirees say they retired earlier than intended, a consistent finding for years, according to the EBRI survey.

Some say increasing that eligibility age for partial benefits could help keep older Americans in the workplace.

"If as a society we want individuals to continue working longer, then probably the only change in Social Security policy that can definitively do that is to increase the age of first eligibility," said Dallas Salisbury, president of EBRI. "The data suggests that large numbers of people would work longer because they basically would have no choice."

|

|