|

|

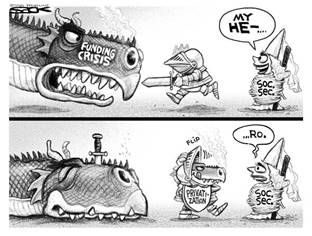

Social Security Not Facing Crisis, Democrats Say

By Lawrence M. O'Rourke, Star Tribune

January 17, 2005

Steve Sack, Minnesota, The Minneapolis Star-Tribune

``Social Security faces a challenge, not a crisis,'' said Rep. Sander Levin of Michigan, ranking Democrat on the House Ways and Means Committee who has taken the key role in the debate left vacant by the death of Rep. Robert Matsui,

D-Calif.

``There is no short-term crisis,'' said Kenneth Apfel, commissioner of Social Security during the Clinton administration. He said Social Security's outlook, which the president depicts in the bleakest of terms, is a ``long-term manageable challenge.''

Talk of a Social Security crisis is ``nonsense,'' said Henry Aaron, Social Security analyst at the Brookings Institution. ``It is fundamentally dishonest. It is intended to stampede the American public into extreme ideological changes.''

Sen. Edward M. Kennedy, D-Mass., said the president has undermined his case for changing Social Security by contending that the system is in crisis. ``My sense is that his plan isn't going to make it through Congress.''

The president, promising to spend the political capital he says he won in November, has made Social Security overhaul the top item on his domestic agenda for this first year of his second term.

He is pushing it relentlessly, though he has yet to present details of what he wants to do, putting that off until next month.

But Social Security trustees, supplemented by the Congressional Budget Office, a special presidential blue-ribbon panel and numerous advocacy groups and think tanks have illuminated the future of Social Security as it now operates.

Starting in 2018, benefit payments will begin to exceed the combination of payroll tax revenue and the funds Social Security receives from taxation of a portion of the Social Security benefits received by higher-income beneficiaries.

In 2028, annual revenue and interest earnings will no longer be able to cover all benefits. The trustees will have to start redeeming Treasury bonds that Social Security holds.

By 2042 (according to the trustees, 2052 according to the CBO), Social Security will not have enough money to pay full promised benefits; it could only pay 70 percent of promised benefits. That would last until 2078, when a combination of factors might allow a slight increase.

The situation can largely be traced to the impending arrival later this decade of World War II baby boomers as Social Security beneficiaries.

``Between 2011 and 2030, the number of Social Security recipients will increase 65 percent while the working tax-paying population will only increase 8 percent,'' said Sen. Lindsey Graham,

R-S.C.

The situation is no surprise. There have been attempts to fix it, but none as significant as Bush's.

Karl Rove, the president's top political adviser, is packaging a major effort that will fan out Cabinet officers and top administration officials across the nation to promote the idea that Social Security is indeed in a crisis that cannot be resolved by anything less that sweeping change.

Encouraged by Rove, a group of business organizations, including the Chamber of Commerce and the National Association of Manufacturers, has mobilized on behalf of the proposal.

The group is expected to spend several million dollars on a national advertising blitz for the president's plan, just as the AARP, with 35 million members, intends to spend more than $5 million in opposition.

Congressional Democrats and their allies contend that Social Security's problems can be fixed without diverting funds to voluntary private accounts.

Key Democrats, including Kennedy and Levin, decline to offer an alternative to the Bush proposal for individual private accounts. Democrats said they might get together on an alternative later, but not until after the president lays all his cards on the table.

|

|