|

|

Many Britons Sour on Private Pension Experiment

By Alan Cowell, The New York Times

Great Britain

December 9, 2004

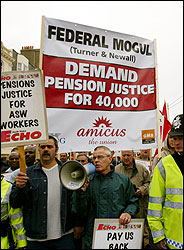

Workers and retired people protesting against pension insolvency outside the Labor Party conference in Brighton, England, in September.

Like the United States, the British face a substantial gap between the amount taxpayers are expected to contribute to financing pensions and the benefits that retirees are scheduled to receive. Without changes, Britain runs the risk of a $110 billion gap in its pension system by 2050. Yet previous efforts to tinker with the country's tangled web of government and private benefits have produced what a commission headed by Mr. Turner called "the most complex pension system in the world."

It was precisely the impulse in Britain to mix the government retirement plan with the private pension market that led to much confusion and substantial financial losses for pension funds and savers in recent years. If anything, the result has been to press many savers back into the government system and away from private experiments.

"We would start by saying, 'We wish we had started with your problem,' " Mr. Turner said, referring to what British experts see as attributes of the American system: strong population growth and a readiness to work longer into old age, which make changes less pressing than they are here. Indeed, Mr. Turner said, compared with British National Insurance, the American system looks far more robust.

That is hardly the emphasis in Washington. President Bush has said he wants to add voluntary personal investment accounts to Social Security, allowing workers to switch part of their payroll taxes into stocks and bonds for their retirement.

Mr. Bush has not said precisely how this would be achieved. But he has indicated that a starting point might be proposals from a commission three years ago, with Daniel Patrick Moynihan as its co-chairman, who supported the idea of personal accounts.

As in Britain, Washington's intention is to address a solvency problem that is expected to intensify in the next few decades as the baby-boom generation reaches retirement age, requiring future workers to shoulder a greater burden to support retired people.

That kind of problem is compounded in Britain, and to a greater extent in much of Continental Europe, by birth rates lower than those in the United States - meaning that a prospectively smaller number of taxpayers will be supporting a larger number of pensioners living longer lives.

Britain took the first steps to try to deal with its problems in the late 1980's, when a government-sponsored program began offering millions of Britons the chance to set up what were called personal pensions - similar to the private accounts that President Bush has suggested should be an alternative, in part, to Social Security for future retirees.

But, according to a report in October by the British government's Pensions Commission, led by Mr. Turner, many changes in the system "appeared to make sense at the time" but ended up creating "bewildering complexity in the state system, in the private system and in the interface between them."

Not only that, the looming crisis in government pensions here has coincided with a fundamental shift in the privately run workplace pensions that once guaranteed many middle-class Britons a comfortable retirement.

"The occupational pension scheme was one of the great successes of the 20th century," said Andrew Fleming, a spokesman for the National Association of Pension Funds. "The danger is that it's not going to be there in the 21st century."

The catalog of problems is a long one, but the conclusion is straightforward: government spending is projected to shrink, in real terms adjusted for inflation, by 26 percent for each pensioner over the next four decades, according to the Pensions Commission report. But some 12 million of Britain's nearly 60 million people are not putting enough aside in private pension plans to offset that decline.

|

|